In the stock markets and the crypto sector, traders are always looking for a specific reason to explain the price movement of an asset, which means it is important to stress that correlation does not imply causation.

While it may be easy to link a pending regulatory statement or legislation to the outcome of an asset’s price, there is not always conclusive evidence that these are the exact drivers. Some of the indications below may have occurred due to pure luck, even if the coincidence persists throughout history.

For example, Bitcoin (BTC) pumping to $48,200 on October 1 may be related to the September 30 remarks by US Federal Reserve Chairman Jerome Powell. When asked to clarify his comments on central bank digital currencies (CBDC), Powell asserted that the Fed had no intention of banning digital currencies.

Another plausible reason for the current rally is that the 7-day average bitcoin hash rate jumped to 145 EH/s, its highest level since the sudden crash in early June when the Chinese mining crackdown intensified.

Finally, the rising expectations of ETF approval by the US Securities and Exchange Commission (SEC) may have played a key role in traders’ recent bullish bets.

What is clear is that several factors could have pushed Oil last week to $49,000, and today the bulls seem to be making an effort to reclaim $50,000. So let’s take a look at 3 indicators flashing a “buy” signal before the recent price action.

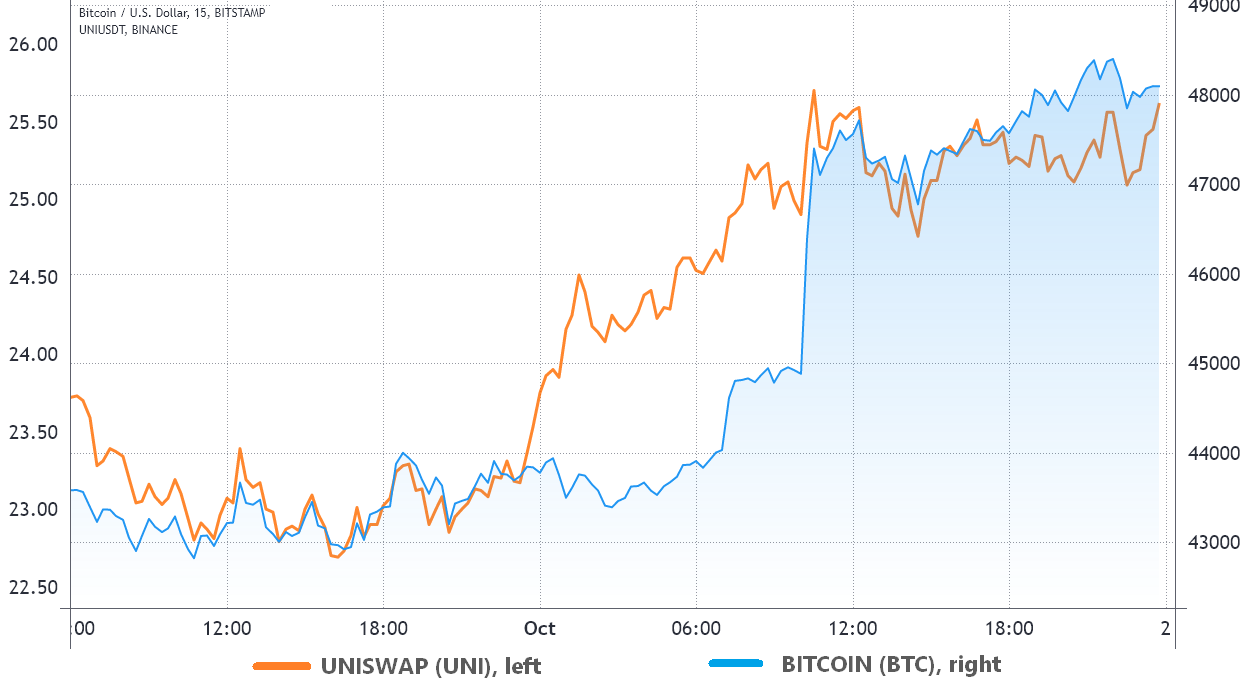

UNI caught by offer after merchants turned their attention to DeFi

UNI, Uniswap’s decentralized exchange token, pumped just hours before the October 1 market rally. The altcoin started increasing its price right away as the monthly UTC close took place, initially by 5% to $24.20 from $23. The move was followed by another 4% pumping to $25.20 three hours before Bitcoin broke above $45,000.

Oddly enough, DEX volumes started picking up after China imposed additional restrictions on Bitcoin the previous week. A reasonable explanation for this move may be that investors begin to understand that China’s actions will not affect trading volume. By moving to DEX, the potential for governments to control or limit cryptocurrency adoption drops significantly.

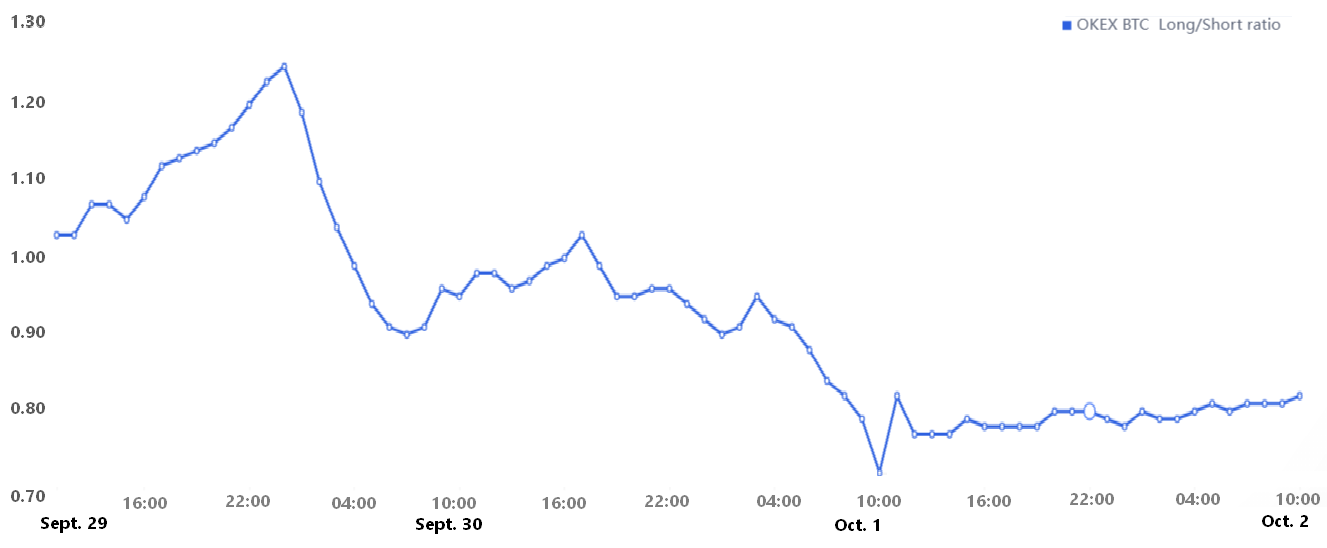

Selling deals on derivatives exchanges saw a slight increase

Some exchanges provide useful information on clients’ net exposure by measuring their positions or consolidating data from the spot and derivative markets. For example, the ratio of long to short for OKEx Bitcoin traders fell from 1.25 (preferring long positions) to 0.72 (favoring short positions) by 28% in less than two days.

This may seem illogical at first, as it shows whales increasing bearish bets, but when market expectations are broken, extreme price moves occur. Had most traders expected a positive price swing, the outcome would likely have already been priced in.

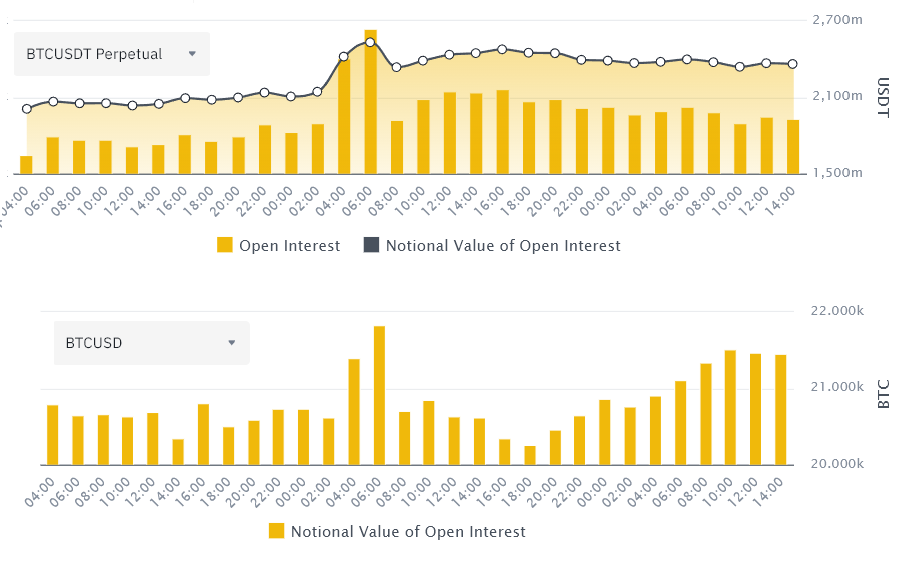

The open interest in futures contracts on Binance has suddenly grown

Regardless of the underlying asset, a futures contract has long (buyers) and short (sellers) contracts that match at all times. This means that there is no way to predict whether these investors are veering to either side.

However, the sudden increases in open interest, which reflects the total number of contracts still in force, reflects confidence. And the more theory involved, the higher the stakes.

Notice how during the four hours prior to the bullish rally at 6:00AM UTC, the sudden rise in interest on both the perpetual USDT and the coin-based contract was open. Interestingly, even with the additional bets of $400 million, the price of bitcoin was only noticeably affected after open interest peaked.

The truth is that one may never reveal exactly what triggered the rally, but by observing similar patterns in the future, traders may be able to predict price pumps. Of course, there is no guarantee that all three indicators will repeat themselves, but the cost of monitoring the data is minimal.

The opinions and opinions expressed here are solely those of author and do not necessarily reflect the opinions of Cointelegraph. Every investment and trading move involves risks. You should do your research when making a decision.