The week-long uptrend in the cryptocurrency market has started to wake bullish crypto investors and the successful March 15 launch of the Ethereum “merger” on the Kiln testnet has the community excited. about the upcoming move to proof-of-stake.

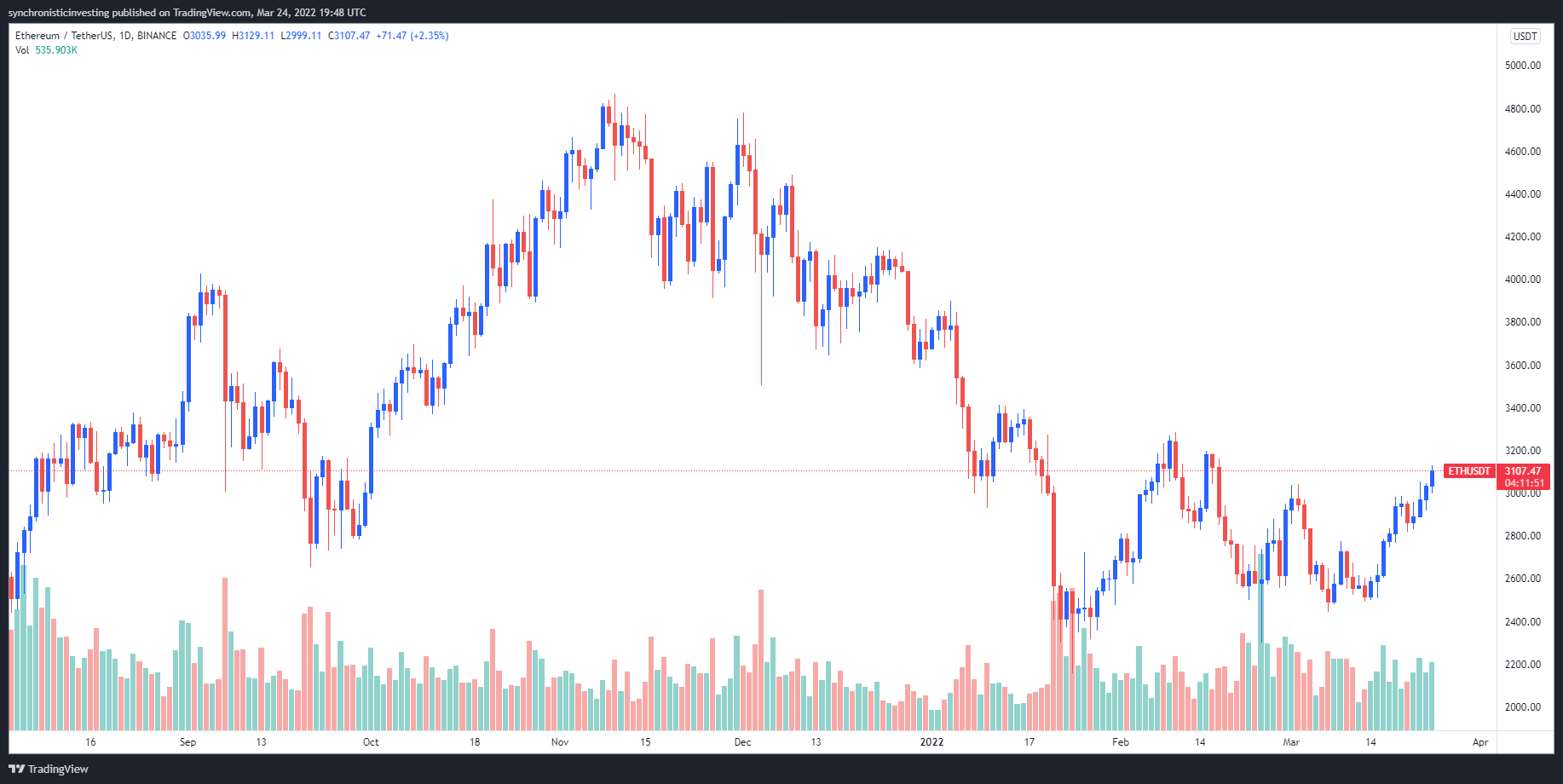

Data from Cointelegraph Markets Pro and TradingView shows that since the successful launch on Kiln, the price of Ether has climbed 25% from $2,500 to a daily high of $3,193 on March 25, as traders are looking to lock in their positions ahead of the merger.

Here’s a look at what market analysts are saying could happen with Ether’s price as the merger nears and how the move to the point of sale could affect its long-term price.

A clear break in the downtrend

Ether’s price reversal over the past two weeks was succinctly addressed by crypto analyst and Justin Bennett, who job the following chart highlighting the trend reversal that has occurred.

Bennett said,

“Ether first highest since early Nov 2021. Probably nothing.”

The merger will be a bullish development

Further analysis of the effects the upcoming Ethereum merger will have on its price was discussed by analysts at independent macro and crypto research house MacroHive, who noted that the merger “will have bullish implications for Ether. “.

According to MacroHive, “the prospect of being able to achieve passive return on staked Ether will draw more investors into the space,” while the transition to proof-of-stake “will reduce Ethereum’s energy consumption by 99%, 95%”.

This will in turn help attract more institutional money into the Ethereum ecosystem as environmental, social and governance (ESG) concerns “around mining/proof-of-work energy consumption are mitigated.”

The merger will also have a noticeable impact on the circulating supply of Ether, as net issuance will experience a significant decline once completed, as block rewards are replaced with Ether staking returns.

MacroHive said,

“This, coupled with Ether’s ongoing burn, should make Ether deflationary and that should be broadly bullish.”

Related: Crypto Rally at $2,000 Market Cap as Institutions Signal They Are Ready to Enter

Merger Could Mirror Halvings of Bitcoin

A final look at the effects of the upcoming merger came from options trader and pseudonymous Twitter user McKenna, who posted the following tweet comparing the effects of the merger to those of Bitcoin’s halvings.

The merger is a crowded trade, but so is the BTC halving.

The only difference is that ETH becomes a deflationary asset with EIP1559.

The adoption of the S-curve as a fundamental Web3 protocol will send ETH to monumental heights over the next decade.

You are not ready Anon.

— McKenna (¤, ¤) (@Crypto_McKenna) March 23, 2022

The overall cryptocurrency market capitalization now stands at $1.997 trillion and Ether’s dominance rate is 18.7%.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.