Self-regulatory organization CryptoUK and crypto exchange Kraken criticized a recent report from a panel of UK lawmakers suggesting that crypto should be regulated in the same way as gambling.

In a May 17 report, the House of Commons Treasury Committee “strongly recommended” that unbacked crypto be regulated as gambling due to concerns about “significant” consumer risks associated with the crypto class. assets, such as price volatility and lack of intrinsic value.

He finally called for cryptography to be regulated according to the principle of “same risk, same regulatory outcome.

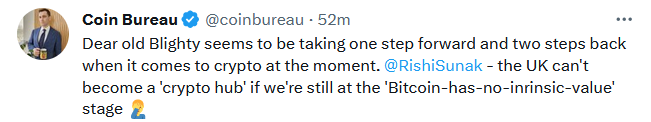

This move has not gone down well with local players, especially as the UK is supposedly heading towards a progressive crypto hub.

In a May 17 statement shared with Cointelegraph, CryptoUK argued that “taking this approach will not take into account the nuances of the industry and the real opportunities for inward investment and growth for the UK economy as a whole.” , adding that:

“No other global jurisdiction has taken this approach, and by referring to MiCA in the EU, we need to take a tailored and tailored approach to regulation within the industry to ensure the UK does not not become a hostile environment for domiciled businesses.”

The organization also suggested that such an approach could ultimately lead to consumers in the UK looking for offshore crypto platforms to engage with, which it says is “totally contrary to the purpose of protect these consumers through regulation”.

In Kraken’s statement, the company stressed that it “fundamentally” disagrees with the “Treasury’s conclusion that crypto-assets have no intrinsic value.”

Related: UK financial watchdog announces inspections against suspected illegal crypto ATM sites

“It is unfortunate that the committee does not support the UK’s opportunity to be a true global leader in our rapidly developing industry,” the company said, adding:

“The committee’s suggestion that crypto assets should be regulated as gambling products is misguided and totally unsuitable for UK consumers.”

He argued that it not only “misses the purpose and potential of the technology,” but said gambling protections do not provide the same safeguards as financial services regulation.

CryptoUK highlighted a potential loss of capital gains tax if crypto trading was considered gambling:

“Gambling is exempt from capital gains tax. Does the UK government want to exclude tens of millions of pounds of tax revenue from gains made from the purchase and sale of non-purchased crypto assets? guaranteed?”

Of course not, but it’s so stupid that it’s the result of a consultation that was VERY followed by written evidence from those involved

— Laurence (@fucti0nZer0) May 17, 2023

The precise extent to which crypto would be regulated “as gambling” has not been defined by the Treasury; however, the report recommended imposing strict regulations and guidelines regarding consumer protection, anti-money laundering and anti-terrorist financing.

Magazine: Cryptocurrency Trading Addiction – What to Look for and How to Treat It