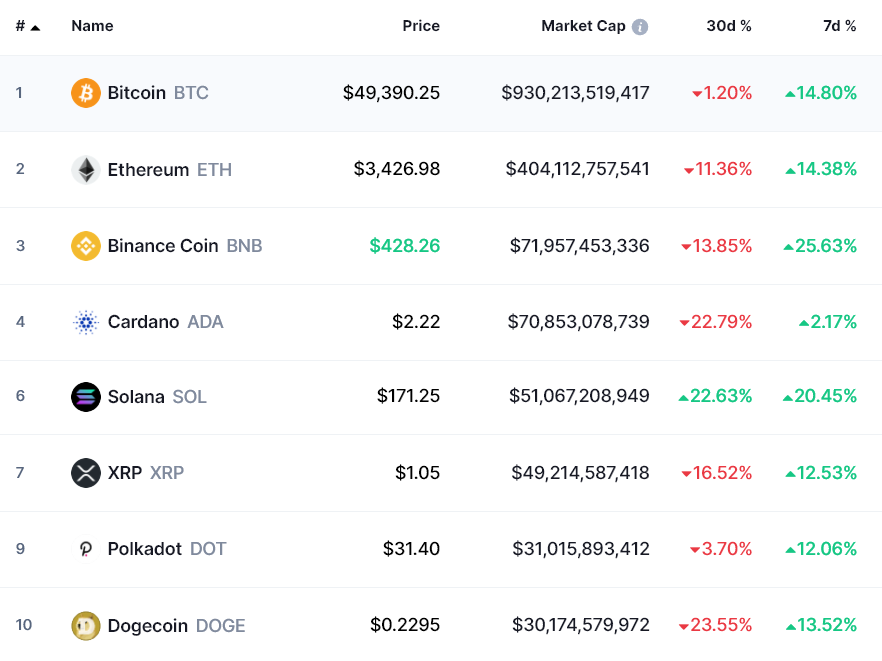

Cryptocurrency markets are up 12.5% over the past seven days to reach $2.44 trillion in market capitalization. However, this move does not seem to inspire confidence as the same level was tested 16 days ago when a 27% retracement was followed by Ether (ETH) attempt to break $3,650 over the next six days.

Regulation appears to be a major concern for buyers as the US House of Representatives is expected to vote on the $1 trillion infrastructure bill this month. In addition to determining who qualifies as an intermediary, the legislation imposes anti-money laundering (AML) and know-your-customer (KYC) requirements on many types of cryptocurrency transactions, which can also be harmful to DeFi protocols.

As explained above, the negative performance seen in the top 10 cryptocurrencies has affected investor sentiment over the past 30 days. For this reason, it is important to measure more than just the nominal price of Bitcoin. Traders should also analyze BTC derivatives indicators such as the futures market premium and options skew.

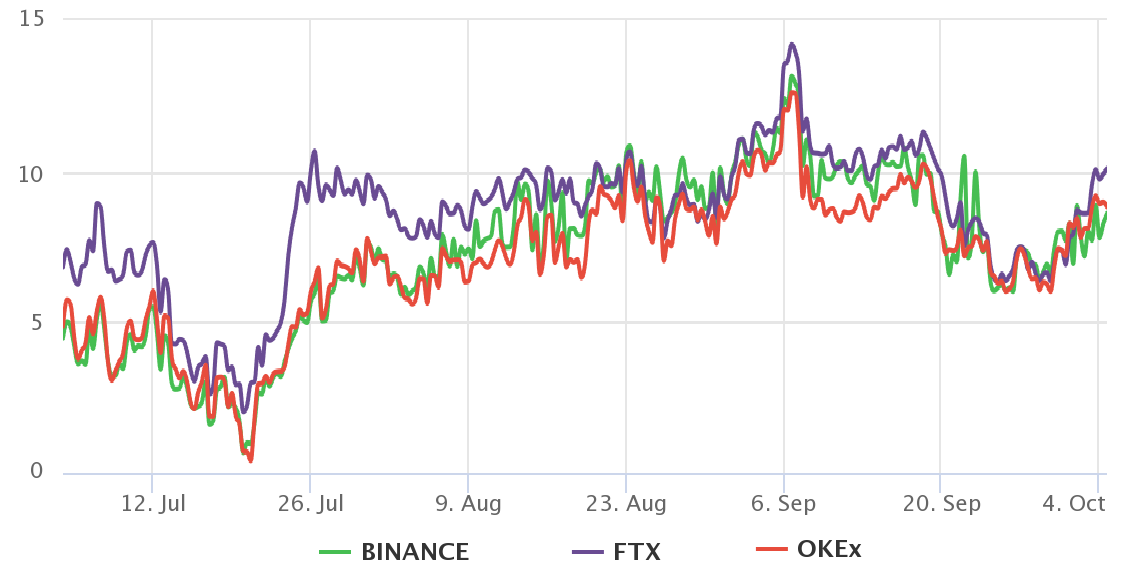

The futures premium shows that traders are slightly bullish

The underlying price is often referred to as the futures premium and measures the difference between long-term futures contracts and current spot market levels.

Expect 5% to 15% annual premium in healthy markets, a situation known as contango. This price difference is caused by sellers asking for more money to withhold settlement for a longer period.

As shown above, the current 9% annual premium is neutral but shows an improvement over the past two weeks. This indicates that traders are cautiously optimistic, leaving room for more long leverage when confidence is fully restored.

Options Traders Get Out of a ‘Fear’ Mode

To rule out the externalities of a futures instrument, one must also analyze the options markets.

A delta deviation of 25% compares similar call (buy) and put (put) options. The scale will turn positive when “fear” prevails because the premium of protective put options is higher than comparable risk call options.

The opposite is proven when the market makers are bullish, causing the 25% delta skew indicator to turn into negative territory. Readings between negative 8% and positive 8% are considered neutral.

Notice how bitcoin options traders entered the “fear” level on September 25 as the $41,000 support was tested multiple times. With that said, there has been a drastic change since September 30th, and the index is now in neutral territory.

Under the current situation, the futures and options basis deviation of 25% shows a typical “glass half full” scenario. This means that even though Bitcoin reached a 27-day high above the $50,000 resistance, there is still room for buyers to squeeze in additional leverage before the metrics flash signs of excessive stretch or euphoria.

The $50,000 breakout of current meager derivatives data is usually interpreted as weakness. However, given that the total crypto capitalization is still in the same place as it was 30 days ago and the regulatory concerns are not mitigated, there is nothing to worry about. At the moment, neither the futures nor the options markets are showing any signs of a downside.

The opinions and opinions expressed here are solely those of author and do not necessarily reflect the opinions of Cointelegraph. Every investment and trading move involves risks. You should do your research when making a decision.