Bitcoin (BTC) remains below $40,000 for the third day in a row and the most likely source of volatility is the deterioration in the state of traditional markets. For example, the S&P 500 is down 5% since April 20, the price of WTI crude has fallen 9.5% in seven days, erasing all the gains accumulated since March 1.

Meanwhile, China is struggling to contain its worst Covid-19 outbreak despite strict lockdowns in Shanghai and according to Timothy Moe, chief Asia-Pacific equity strategist at Goldman Sachs, “it’s no surprise, and it makes perfect sense that the market should be concerned about the Covid situation as it is clearly impacting economic activity.”

Investors have been driven out of risky assets

As the global macro scenario deteriorated, investors took profits on riskier assets, causing the US Dollar Index (DXY) to hit a 25-month high at 101.8.

Cryptocurrency mining activity has also faced regulatory uncertainties after U.S. House of Representatives member Jared Huffman and 22 other lawmakers asked the Environmental Protection Agency to to assess whether cryptocurrency mining companies were potentially breaking environmental laws on April 21.

Despite Bitcoin’s 4-day price correction of 10% to $38,200 on April 25, most holders are opting to remain unmediated, as confirmed by on-chain data from Glassnode. The proportion of supply that has been dormant for at least 12 months is now at an all-time high at 64%. Thus, it is worth exploring whether the recent price rejection has impacted the mood of derivatives traders.

Derivatives Markets Show Bearish Bitcoin Traders

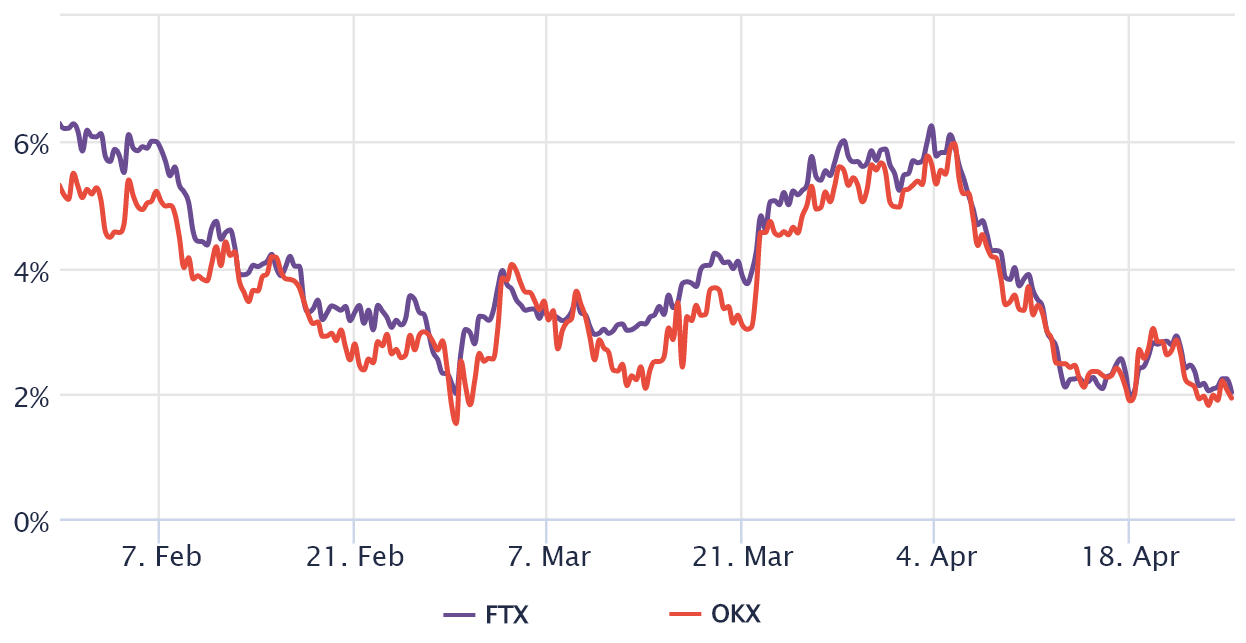

To understand if the market has turned bearish, traders need to look at the Bitcoin futures premium (basis). Unlike a perpetual contract, these fixed-timeframe futures do not have a funding rate, so their price will be very different from regular spot trades.

A trader can gauge the level of upside in the market by measuring the spend gap between futures contracts and the regular spot market.

Futures should trade at a 5-12% annualized premium in healthy markets. Yet, as noted above, Bitcoin’s basis broke below such a threshold on April 6 and currently sits at 2%. This means that the futures markets have been showing bearish momentum over the past couple of weeks.

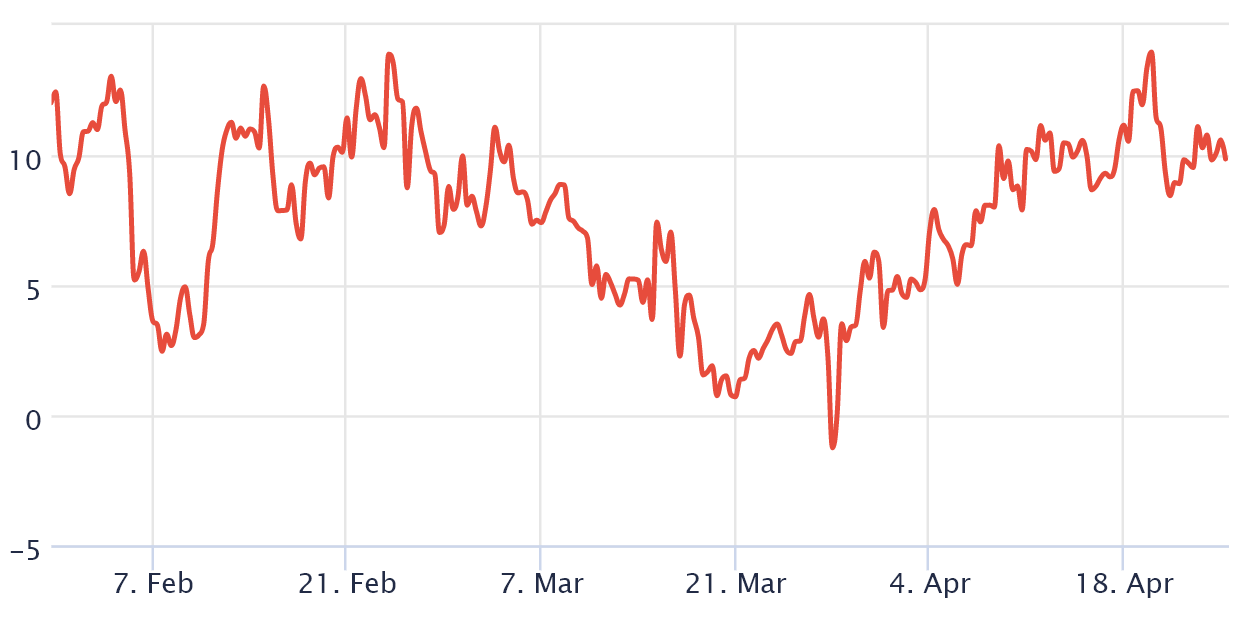

To rule out futures-specific externalities, traders must also analyze options markets. For example, the 25% delta skew compares similar call (call) and put (sell) options.

This measure will turn positive when fear prevails, as the protection premium of put options is greater than that of similarly risky call options. Meanwhile, the reverse occurs as greed emerges, causing the delta asymmetry indicator to move 25% into the negative zone.

If options investors feared a price crash, the bias indicator would jump above 8%. In contrast, generalized excitement reflects a negative bias of 8%. The metric turned lower on April 7 and has since held above the threshold.

Related: Bitcoin sets lowest weekly close since early March as 4th red candle looms

Traders will resist possible price pumps

According to Derivatives Indicators, it’s safe to say that professional Bitcoin traders became more uneasy as Bitcoin tested the $39,000 support.

Of course, none of the data can predict whether Bitcoin will continue to decline, but given the current data, traders are overcharging for downside protection. Therefore, any surprise price rally will be questioned.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.