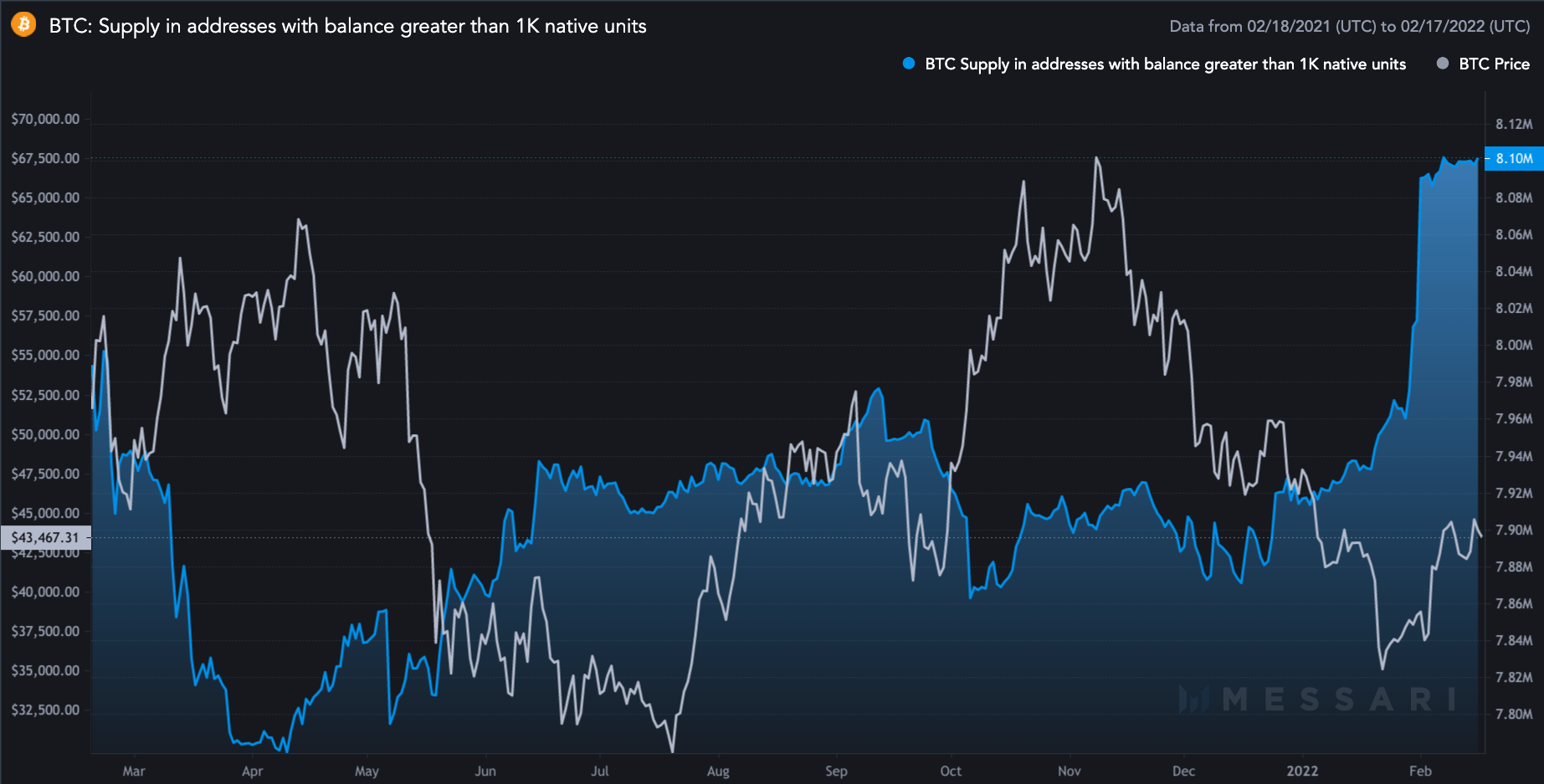

A slight increase in the supply of Bitcoin (BTC) to whale addresses seen in January appears to stall midway through as the price continues its intraday correction towards $42,000, according to the latest data from CoinMetrics.

Whales, fish take a break from Bitcoin

The sum of Bitcoin held in addresses with a balance of at least 1,000 BTC stood at 8.10 million BTC as of February 16, up nearly 0.12% since the start of the month. By comparison, the balance was 7.91 million BTC at the start of this year, up 2.4% year-to-date.

Notably, accumulation behavior among Bitcoin’s wealthiest wallets began to slow after BTC closed above $40,000 in early February. Their supply fluctuated in the range of 8.09 to 8.10 million BTC while Bitcoin did the same between $41,000 and $45,500, signaling that demand for whales has diminished inside said trade zone. .

A similar outlook emerged in addresses that hold less than 1 BTC, also known as “fish”, showing that they had halted Bitcoin’s accumulation in February as its price entered the 41,000-45,500 price range. $.

It seems that the hoarding trend is stagnating with #BTC approximately $44,000:

No break for whale addresses.

Tray for small fish.I guess everyone is cautious waiting to see what the FOMC does next. pic.twitter.com/Ou8w1t7U5m

— ecoinometrics (@ecoinometrics) February 17, 2022

Ecoinometrics analyst Nick blamed the Federal Reserve’s aggressive tightening plans for making Bitcoin whales and fish “cautious,” reiterating his statements from last week, in which he warned that “if Bitcoin has greatly benefited from quantitative easing, it may also be affected by quantitative tightening”. .”

“That’s why inflation showing no signs of abating is a big problem.”

No dot plot yet

On Wednesday, the Federal Open Market Committee released the minutes of its January meeting, revealing a group of deeply alarmed central bank governors appearing more willing to raise rates too much to contain inflation.

As to how fast and how far the rate hikes would go, the minutes left no indication.

To hike or not to hike? The Fed is keeping Bitcoin markets in limbo. https://t.co/O0ty3kHKc8 pic.twitter.com/R4io3NMLia

– Crypto Markets (@CointelegraphMT) February 17, 2022

Vasja Zupan, chairman of the Dubai-based Matrix exchange, told Cointelegraph that the fed funds futures market now sees a 50% possibility of a 50 basis point rate hike in March, a decline from 63% previous. But the minutes themselves do not mention anywhere an interest rate increase of 0.5%.

“Of course, the mixed macro outlook has left Bitcoin’s most influential investors – whales and long-term holders – in the dark,” Zupan asserted, adding:

“The major cryptocurrency has been blindly following daily trends in the US stock market. However, I consider it weighted and insignificant in the long term, especially as Fed bosses – hopefully – throw more light on their dot-plot after the March hike.”

Strong sense of loyalty

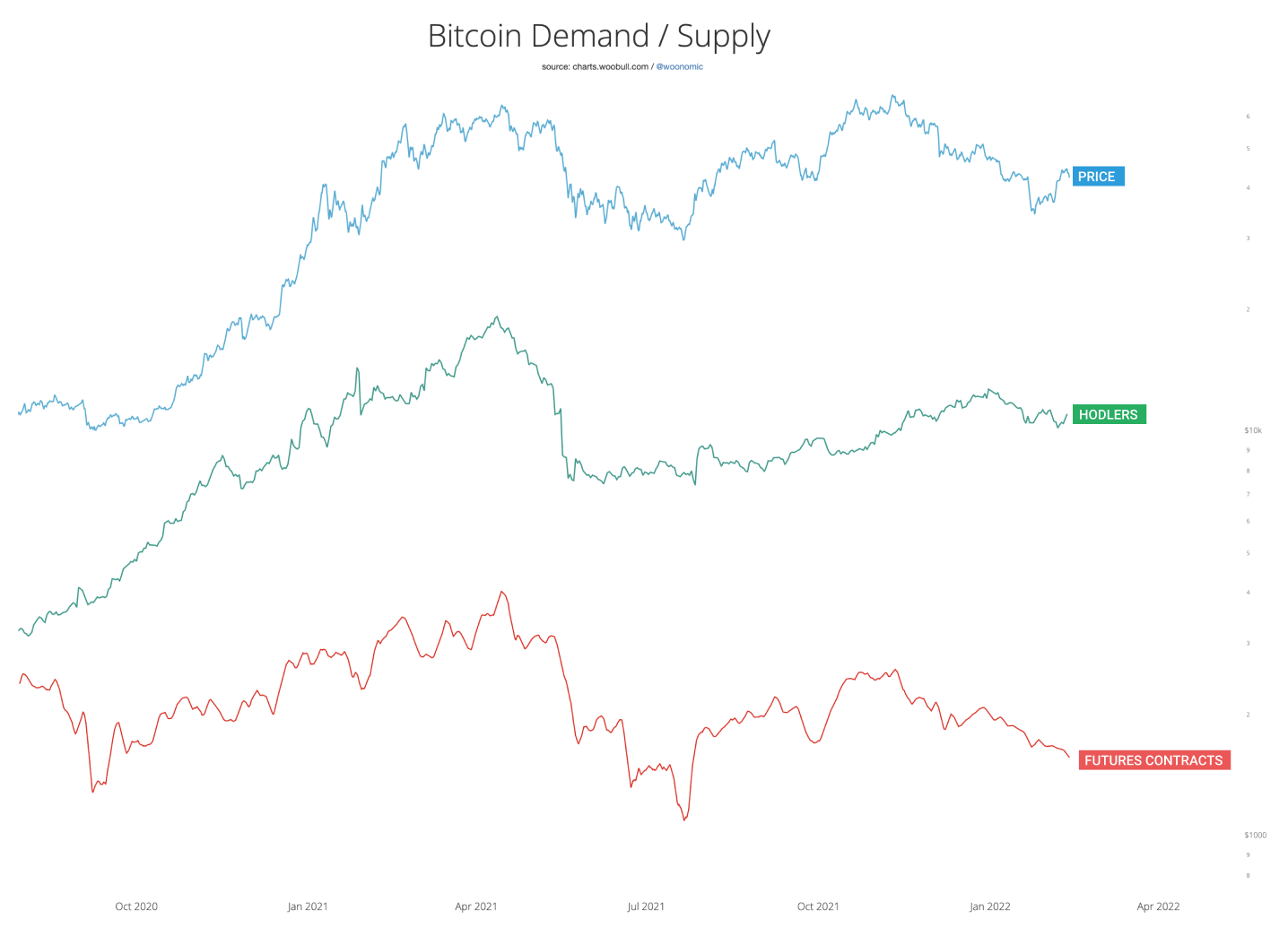

Researcher Willy Woo provided a long-term bullish outlook for Bitcoin, noting that its recent price declines, including the 50% drop from $69,000, were due to selling in the futures market, not to on-chain investors.

“In the old regime of a bearish phase (see May 2021), investors would simply sell their BTC for cash,” Woo wrote in a note posted on February 15, adding:

“Under the new regime, assuming the investor wants to stay in cash rather than rotating the capital into another asset like stocks, it is much more profitable to hold BTC while shorting the futures market.”

Related: Bitcoin Briefly Dip Below $43,000 as Fed Says Rate Hike ‘Will Be Appropriate Soon’

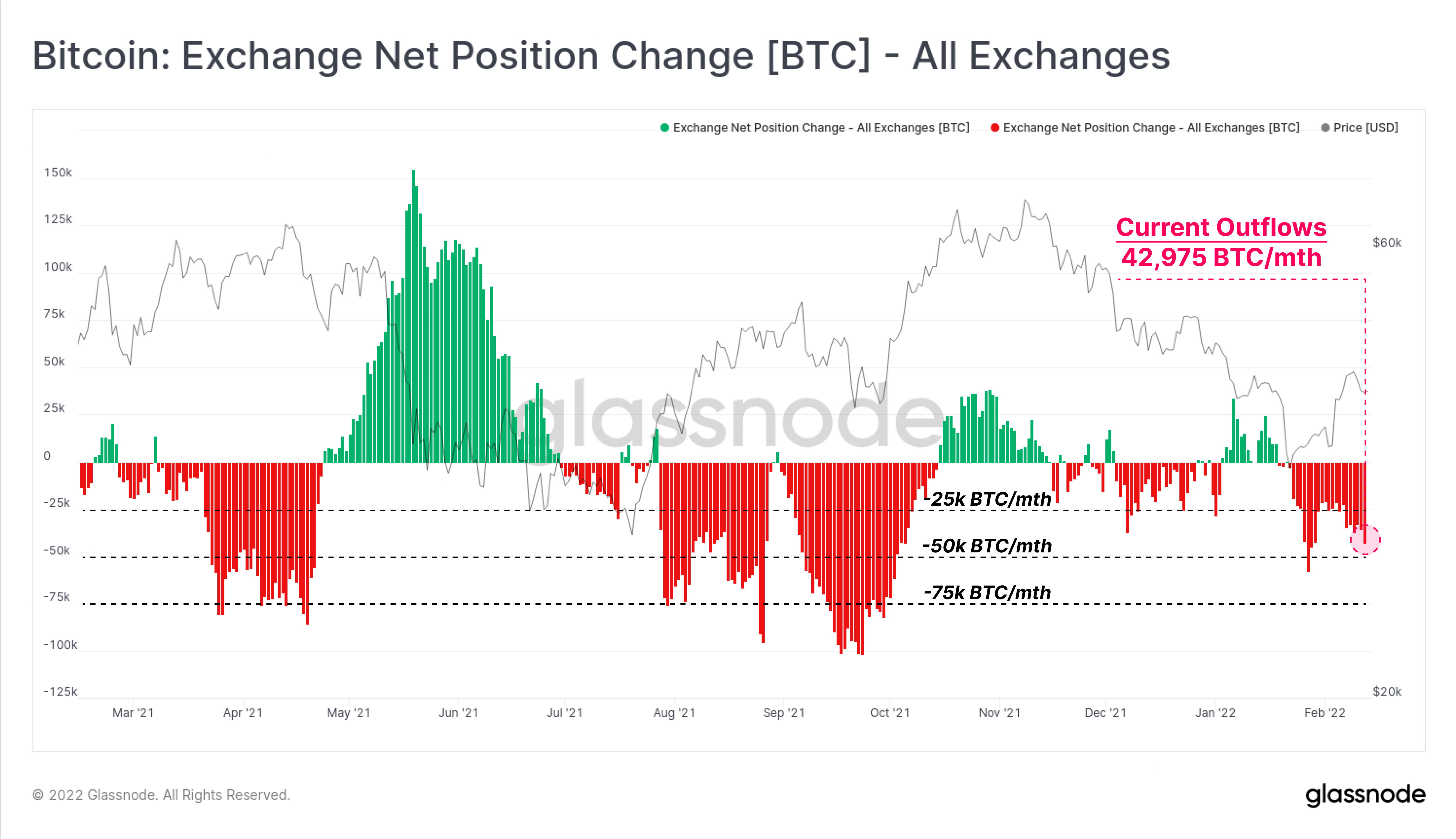

As Glassnode further noted, during the May-July 2021 session, investor risk reduction in the Bitcoin futures market coincided with a coin sell-off in the spot market, which was confirmed by an increase in the net inflow of coins to exchanges. But this is not the case in the continued decline in prices, as shown in the chart below.

“Across all exchanges we track, BTC moves out of reserves and into investors’ wallets at a rate of 42.9k BTC per month,” Glassnode wrote, adding:

“This pattern of net outflows has now been sustained for approximately 3 weeks, supporting the current rebound in price from recent lows of $33.5,000.”

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.