Uniswap (UNI) prices posted a strong recovery after last week’s crash in the wake of China’s decision to intensify its anti-BTC and crypto rhetoric.

UNI price rose 14.90% on Monday to reach an intraday high of $26.26. The rise of UNI/USD came a day after it fell to a monthly low of $17.63. As a result, it has generated more than 48% of profits for buyers in the last 24 hours.

FOMO . Adoption

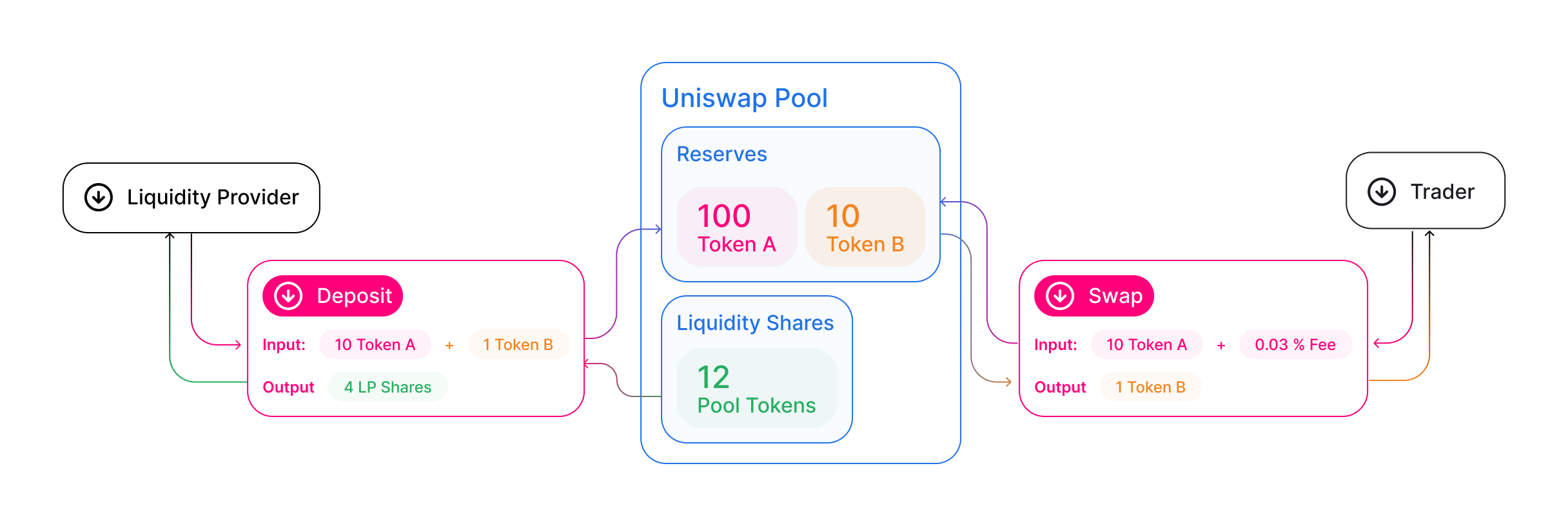

UNI acts as a governance symbol within Uniswap’s Decentralized Exchange (DEX) ecosystem. As a result, holders get to vote on matters that help guide the future direction of the DEX platform.

In addition, UNI holders can also get a potential revenue share in the future. For starters, the Uniswap management contract contains what’s called a “fee switch”; If activated, it would enable UNI holders to earn a portion of the protocol fee.

Some users are already generating revenue by contributing to Uniswap’s asset pools, earning between 0.05% and 1% of the value of each trade in the current version.

Therefore, the growth potential of Uniswap as a DEX may also imply a higher dependence curve for UNI. Thus, it appears that China’s intensified crackdown on the cryptocurrency industry has boosted the token’s appeal among speculators.

The People’s Bank of China (PBoC) and other government agencies have deemed crypto transactions illegal in an announcement posted on Friday. Meanwhile, they have also targeted offshore cryptocurrency exchanges, warning that it is illegal to provide online trading services to Chinese residents.

The move fixed a loophole that remained in place after the PBoC banned all regional financial institutions from providing services to crypto firms. During this time, traders in China continued to use third-party crypto exchanges such as Huobi, Binance, and OKEx.

broke down: # Hobi And #financeThe world’s second largest cryptocurrency exchange, has now suspended all new users from mainland China entirely after the Chinese government announced # bitcoin Trade is illegal. pic.twitter.com/ILExeMmgBU

– Mr. Whale (@CryptoWhale) September 26, 2021

But decentralized exchanges like Uniswap are trying to move away from government jurisdictions by replacing the portfolio asset model with a non-security model based on smart contracts and multi-signature technology.

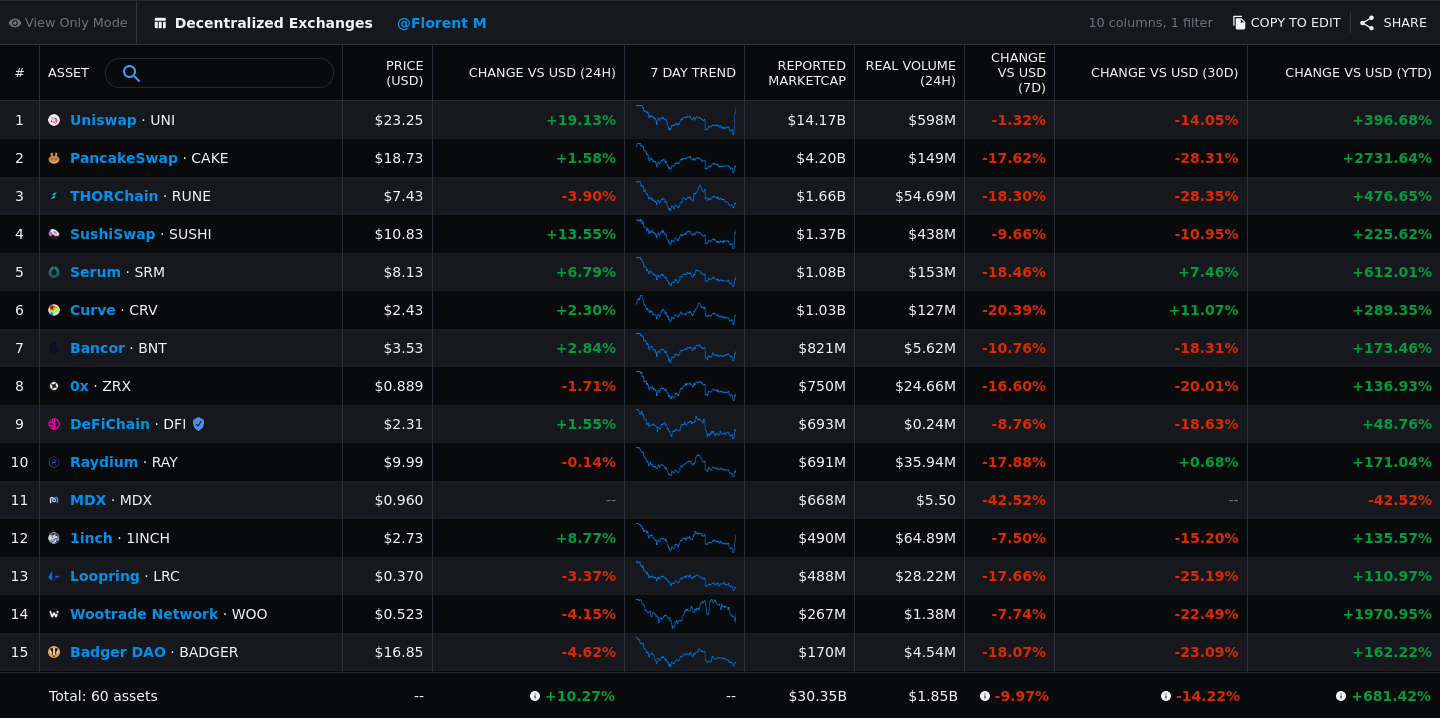

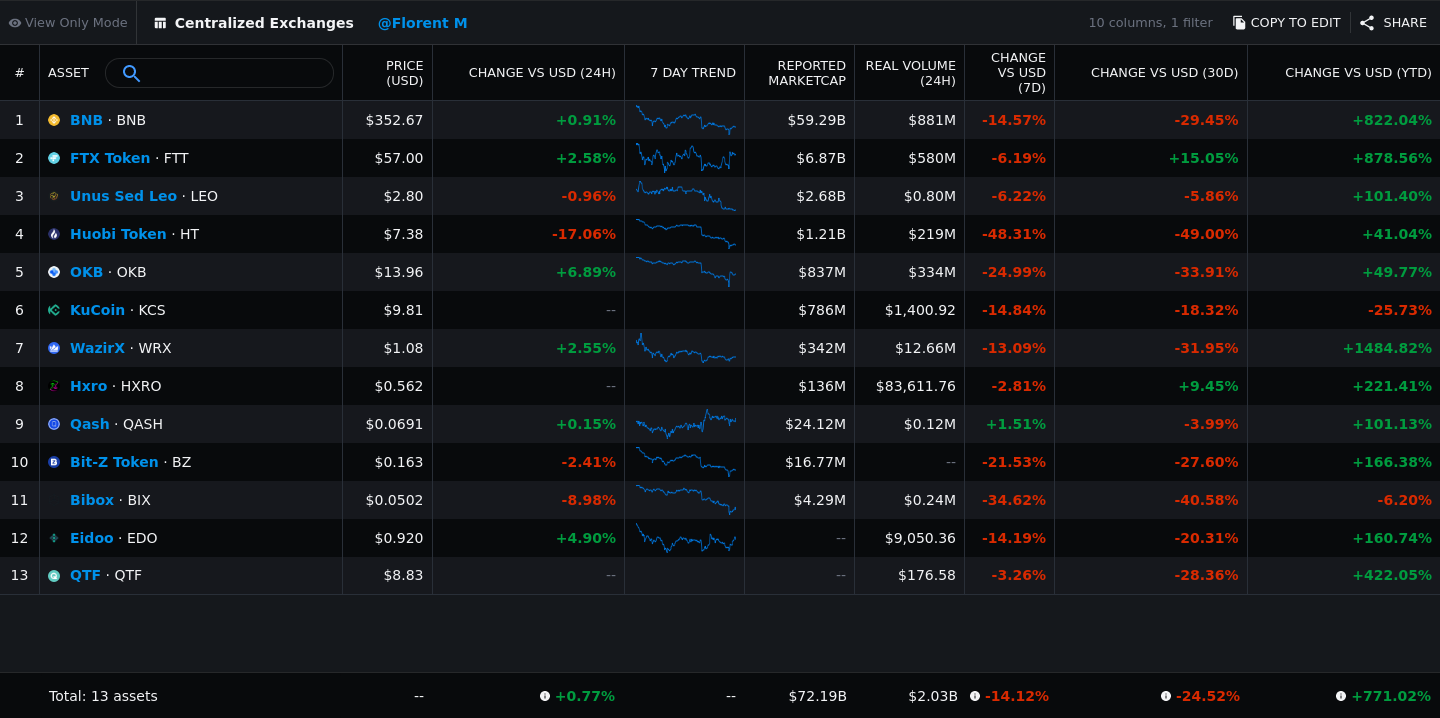

As a result, the recent bout of buying on Uniswap markets has synchronized with similar spikes across the top competing DEX tokens, as shown in the Messari Index below.

Overall, the 60-asset DEX was up 10.27% at around 12:05 UTC, calculated on a modified 24-hour time frame. Meanwhile, gains for 13 central exchange tokens, including Binance Coin (BNB) and FTX Token (FTT), were only 0.77% in the same period, indicating a surprising FOMO for traders to their DEX competitors.

UNI . Technologies

UNI prices are trading lower within a parallel descending channel which appears to be the “handle” of the classic cup and handle technical pattern.

The setting appears when the asset forms a round bottom (cup) during a correction after a strong move higher. After completing the formation, it heads lower within a descending channel range – usually resulting in a breakout to the upside.

Related Topics: Altcoin Report: There’s More to DeFi Than Just Providing Liquidity

Rising in this way, the asset sets its upward target at a distance equal to the depth of the cup.

UNI ticks almost all the boxes when shaping the cup and handle pattern in recent sessions. Uniswap is now looking to break out of the descending handle channel range, with a profit target of $17.83 above the cup resistance at $48.54.

The opinions and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should do your own research when making a decision.