[ad_1]

NFT Whale Jeffrey ‘Machi Big Brother’ Hwang Tosses Over 1,000 Top-Rated Digital Collectibles In 48 Hours

Content

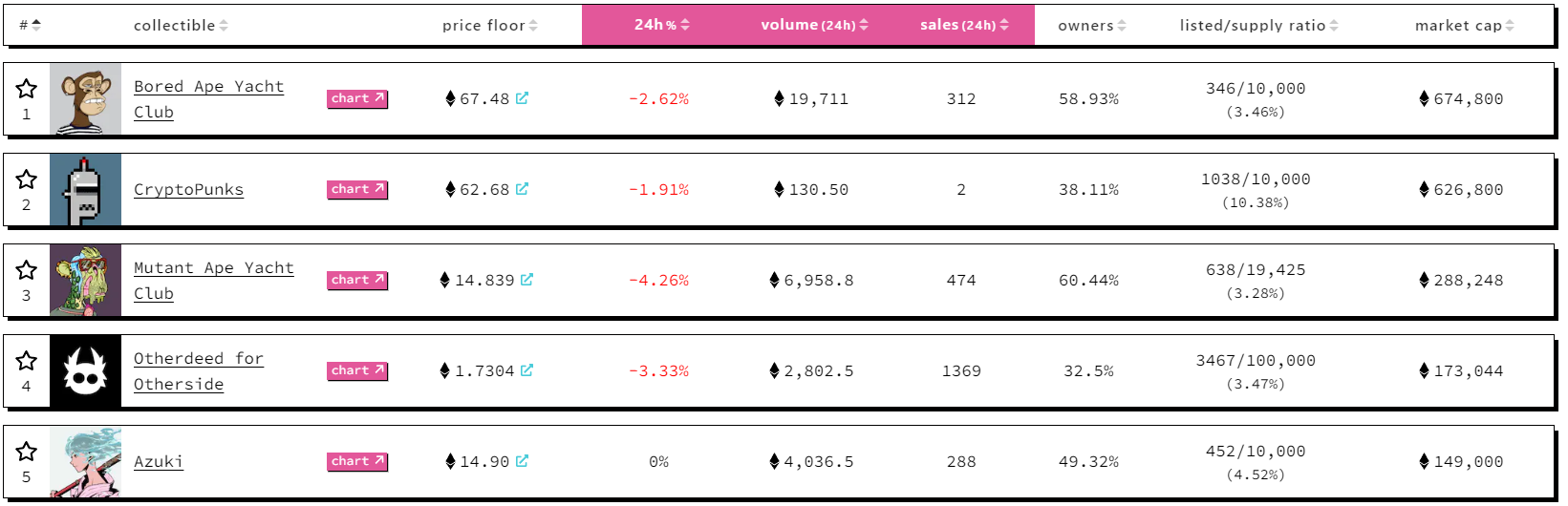

The global NFT community is questioning the motivation of Machi Big Brother, who sold over 1,000 NFTs from four Tier 1 collections for over $18 million in one day. Last week, it became one of the biggest beneficiaries of the Blur (BLUR) airdrop by an upstart OpenSea competitor.

Machi Big Brother Initiates “Biggest NFT Dump Ever”, Says Nansen’s Andrew Thurman

Andrew Thurman, a cryptocurrency analyst at top research firm Nansen, noticed the intriguing activity of Jeffrey Hwang, a veteran NFT trader colloquially known as Machi Big Brother. On February 23 and 24, Hwang sold out his NFTs en masse, including those in the most expensive collections in the segment.

In what is possibly the largest NFT deposit ever, in the past 48 hours Machi has sold 1,010 NFTs, including:

– 90 BAYC for 5707 ETH

– 191 MAYC for 3091 ETH

– 112 Azuki for 1644 ETH

– 308 other deeds for 582 ETHBut it does not save much profit for these collections. For what? pic.twitter.com/4NyMF3gzuy

— Andrew T (@Blockanalia) February 24, 2023

For example, among 1,010 other NFTs, Hwang sold 90 Bored Apes Yacht Club (BAYC) tokens, 191 Mutant Ape Yacht Club (MAYC) tokens, 112 Azukis, and 308 Otherdeed NFTs. In total, Machi Big Brother has earned over $18 million from their sales campaign.

At the same time, he bought out the lion’s share of that huge portion of chips the next day. Additionally, he deposited 7,000 Ether (ETH) in Blur’s (BLUR) depository pool, the most hyped NFT market of 2023 and the most dangerous OpenSea competitor.

The whale still holds 11,000 ETH in various NFTs, so its attack on the markets could be very far from open.

It should be noted that Machi Big Brother received 1 million BLUR tokens following a recent airdrop. He immediately sold all of his airdrop rewards for $1.3 million, Arkham analysts say unveiled.

Top NFT Collections Trading at a Discount

Nansen’s researcher mentioned some aspects of Hwang’s motivation. First, he might be interested in getting additional BLUR airdrops for his business. Then he could simply “book” his profits from previous trades.

Plus, we may be seeing big manipulation: Thurman pointed out that such sell-off campaigns are under the spotlight of NFT traders and could catalyze buying interest in BAYC, MAYC and other big names. collections.

As a result, 21 of the top 25 NFT collections saw their price floor drop in the last 24 hours. CloneX NFTs are the worst performers: their floor price lost 9.2%.

[ad_2]

Source by [author_name]