[ad_1]

Theoretically, it is possible for Nio stock to reach $1,000. Still, this scenario is not too likely as Nio stock price is expected to rise more than 91.5 times from this current price to reach $1,000.

Nio impressed investors in 2020 in 2021, when the stock posted an incredible rally, which eventually peaked at a record price of just under $62. Since then, Nio stock has undergone a sharp price correction, reaching $7.56 in June 2023. With the stock still heavily discounted from its all-time high, Nio is certainly worth a closer look. .

We’ll explore what would need to happen for Nio’s stock price to reach $1,000 and analyze the company’s key growth drivers going forward. Of course, we’ll also look at what could go wrong for Nio investors and provide a Nio stock forecast for 2023 and 2024.

Can Nio stock reach $1,000? The main factors that could help Nio grow

Nio is a China-based automotive company that specializes in EVs (electric vehicles). The company was founded in 2014 and has raised over $5 billion from investors. Nio went public in September 2018 through a listing on the NYSE (New York Stock Exchange).

Nio performed poorly on the stock market after its IPO. After a tough 2019, when the stock fell to $1.51, the stock had a stellar 2020. Between 2019 and 2020, Nio’s share price increased more than 30 times.

Nio is currently expanding into other markets as the company aims to be present in 25 different countries by 2025.

At the time of writing, Nio has a market capitalization of around $18.8 billion. For comparison, Tesla has a market capitalization of $860.7 billion, which is about 45.7 times larger.

Now let’s take a look at some of the key factors that could drive Nio’s growth in the coming years.

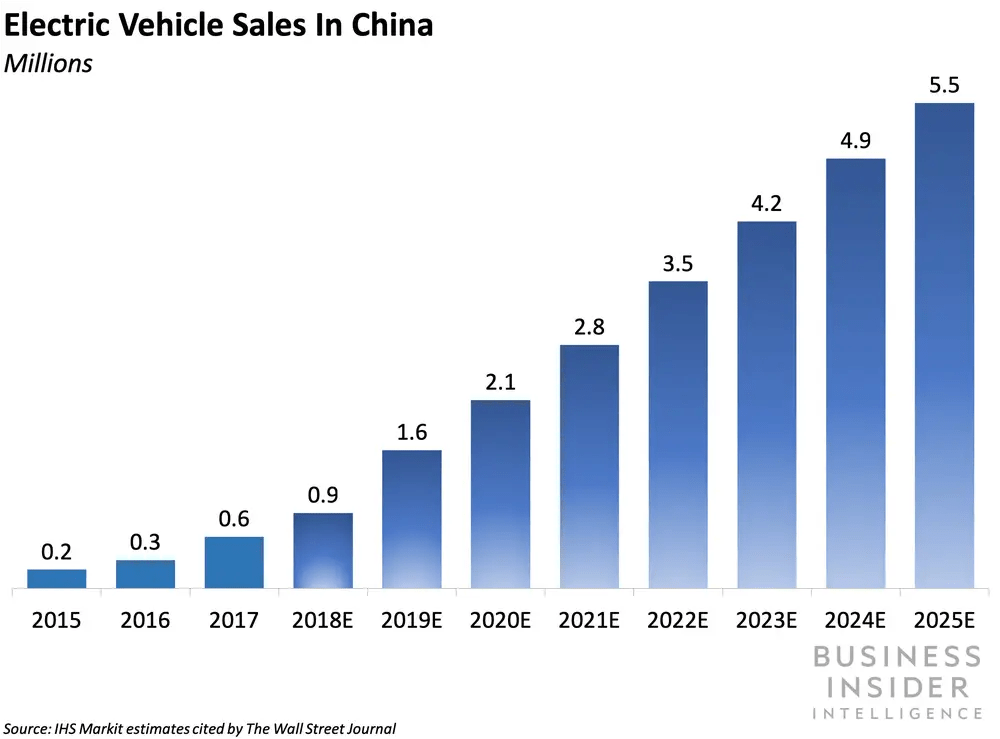

China’s electric vehicle market is growing

According Search for counterpointElectric vehicles now account for a quarter of cars sold in the Chinese market, and China was the second fastest growing market in 2022 among the top 10 electric vehicle markets in the world.

China’s commitment to advancing electric vehicles has fueled a booming sector for electric vehicle producers such as Nio. Favorable initiatives put in place by the government, including subsidies, charging infrastructure and license plate incentives, have greatly increased consumer interest. Nio, with its attractive range of electric vehicles, is set to take advantage of this favorable market environment, which could lead to increased sales and a subsequent upward trend in its market value.

Focus on innovation

NIO has been acclaimed for its innovative and cutting-edge electric vehicles. The company’s focus on delivering an exceptional user experience through distinctive features such as cutting-edge self-driving capabilities and convenient battery swapping stations has generally been positively received.

In 2023, Nio opened an Innovation Center in Berlin, which houses five separate teams developing software used in Nio’s products. The teams will work on areas such as autonomous driving, user interface, voice assistance and other features expected from advanced electric vehicles.

Market share expansion

NIO has gradually expanded its presence in the highly competitive electric vehicle market in China. With an increasing number of vehicle deliveries, the company has demonstrated its ability to secure a greater share of the market.

Expanding its customer base and market share has the potential to drive revenue growth and inspire investor confidence, ultimately propelling NIO’s stock price towards the $100 threshold.

Expansion in international markets

Nio is working to expand its business well beyond the Chinese market. The company plans to be present in 25 different countries and regions by 2025, and has already made inroads in markets like Norway.

What could prevent Nio stock from hitting $1,000?

As we have already explained, Nio would have to grow tremendously for the stock to reach a price of $1,000. In fact, such a scenario is unlikely to occur. Here are the main reasons why it will be difficult for the Nio stock price to reach $1,000.

The electric vehicle market is extremely competitive

Nio has many strong competitors both domestically in China and in international markets. Major players such as BYD and Tesla already control a significant share of the electric vehicle market, and it will be difficult for Nio to take much of the market without major disruptions.

Supply chain and production difficulties

The automotive industry is often disrupted by issues with the supply chain, which can impact companies’ ability to meet production targets. For example, semiconductor shortages have plagued the automotive industry in recent years, making it difficult for companies to meet consumer demand and increase vehicle production.

Changes in government policies

It’s no secret that governments around the world have tried to bolster the electric vehicle industry with various subsidies and incentives. However, such programs can be phased out as quickly as they were introduced, which could make the business models of some electric vehicle companies unsustainable.

Profitability

Although NIO has demonstrated remarkable expansion in terms of revenue, the company has yet to achieve sustained profitability. A variety of factors, including significant research and development expenditures, increased competition and potential margin constraints, may affect NIO’s financial results.

For context, in 2022 Nio reported net income of $49.27 billion but recorded negative income of -$14.58 billion. By comparison, over the same period, Tesla generated $81.46 billion in revenue, accompanied by a net profit of $12.56 billion.

Nio stock forecast for 2023 and 2024

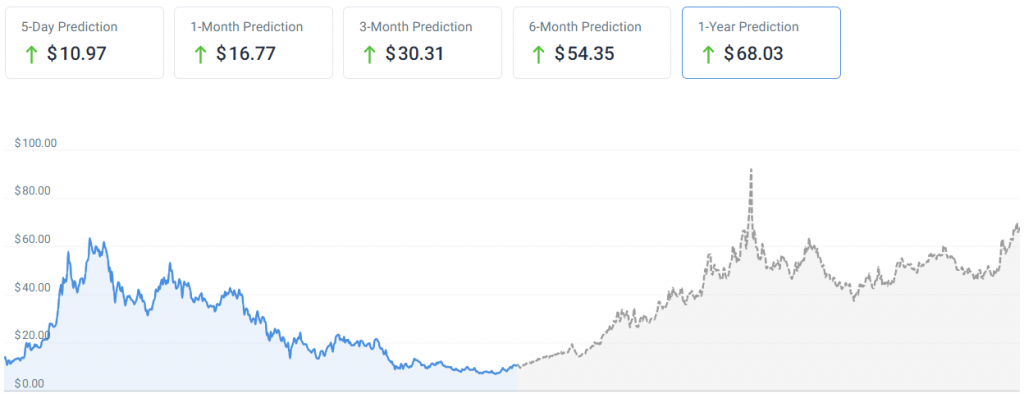

According to the Nio stock forecast on the CoinCodex platform, NIO is likely to end 2023 on a very bullish note. The stock is expected to rally strongly in the final months of the year, reaching a price of nearly $70 by the end of December.

Additionally, Nio’s stock forecast predicts that NIO will reach a new all-time high in January 2024, peaking at a price of approximately $92 per share. For the rest of 2024, the prediction expects Nio stock to be between around $40 and $65.

The bottom line

We can conclude that it will be extremely difficult for Nio to reach a price of $1,000, as this would represent an increase of more than 15 times from its all-time high. If Nio stock traded at a price of $1,000, its market cap would be $1.69 billion, which would be greater than Alphabet’s current market cap ($1.5 trillion) but less than Saudi Aramco, Microsoft and Apple.

While Nio hitting $1,000 isn’t an impossible scenario, there isn’t much evidence to suggest that Nio is heading towards one of the biggest companies in the world.

[ad_2]

Source by [author_name]