Silvergate customers flee as stock prices plummet and regulatory issues mount in the industry. The options for crypto banking partners are shrinking.

The article below is an excerpt from a recent edition of Bitcoin Magazine PRO, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive this information and other on-chain bitcoin market analysis straight to your inbox, Subscribe now.

Trouble Brewing In Crypto-Land

Developments around crypto on- and off-ramps have intensified, as Federal Reserve member bank Silvergate Capital has seen its depositors flee and its stock price plummet. Along with Signature Bank, Silvergate is the other key US bank that works closely with the crypto sector.

The reason for the extreme concentration of bank interests that are willing to deal in the crypto industry is the general lack of regulation around Know Your Customer and Anti-Money Laundering (KYC/AML) policy that exists in the industry for offshore entities, as well as the problems with the entire industry plagued by unregistered security offerings and numerous frauds.

Of course, we believe there is a clear distinction between bitcoin and the general term commonly referred to as “crypto”, but the lines remain blurred for many regulators and government agencies.

Thus, there have always been very few entities in the regulated US banking system that have been willing to work with crypto firms to access established USD on- and off-ramps, which presents a unique challenge for companies that are dedicated to money transfer. and/or process payments and transactions.

Regarding Silvergate, we have been monitoring the situation closely since November – after the collapse of FTX – as it became clear that Silvergate played a role in servicing FTX and Alameda by giving them access to USD rails.

As we wrote on November 17 (emphasis added):

“Who else is at the center of many institutions in the market? Silvergate Bank is one of them. Since early November, their stock is down almost 56%. Silvergate Bank is at the hub of banking services for the entire industry, serving 1,677 digital asset customers with $9.8 billion in digital asset deposits. FTX accounted for less than 10% of deposits and the CEO tried to reassure the markets that their the current loan portfolio has not suffered any losses or liquidations so far. Leveraged loans are secured by bitcoins which can be liquidated if necessary. Yet the current risk is a complete bank run on Silvergate deposits. While the CEO’s comments sound reassuring, the stock’s performance over the past two weeks tells a much different story. — The contagion continues: top crypto lender Genesis is next on the chopping block

Since the FTX implosion, shares of Silvergate Capital have fallen 83%, bringing the current decline from the record price of 97.3%.

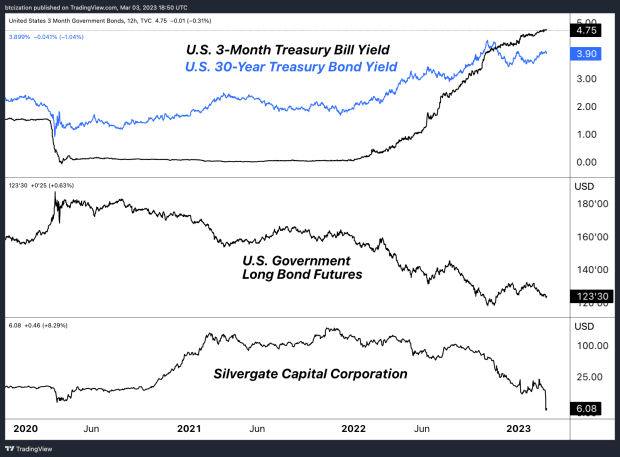

As noted in the November 17 article, Silvergate’s stock price is not imploding due to the performance of a crypto token as it did for many companies during the crypto winter of 2022. but rather from an exodus of deposits which forced the company to liquidate long-loss duration securities in order to remain liquid.

As a traditional fractional-reserve bank, Silvergate took customer deposits — which grew significantly in 2021 — and lent them out over a long term, in US Treasuries, among other things. In practice, companies loaned their money to Silvergate by depositing at 0% in order to use their Silvergate Exchange Network (SEN), and Silvergate then loaned those same dollars at a higher interest rate over an extended period. This is a great business model, as long as your loan values don’t drop when customers withdraw their funds.

“Clients withdrew approximately $8.1 billion in digital asset deposits from the bank during the fourth quarter, forcing it to sell securities and related derivatives at a loss of $718 million, according to a statement Thursday.” — Silvergate collapses after FTX implosion sparked $8.1 billion bank run

As comments mount about the incompetence and irresponsibility of Silvergate management, we must interpret some of the nuances surrounding the situation.

The majority of Silvergate’s deposits were made in a world of zero interest rate policy, where short-term Treasuries offered a yield of 0%. This phenomenon is one of the main reasons why Silvergate has invested in longer life instruments. Bonds have lost value as global interest rates have risen throughout 2022.

With long-term debt securities, money is not lost if interest rates rise as long as the bond is held to maturity (and not in default), but in the case From Silvergate, leaking deposits forced the company to realize the unrealized losses on their securities portfolio — a nightmare for a partially-booked institution.

With growing solvency concerns in recent months, companies have been speculating about exposure to the bank, with names including Coinbase, Paxos, Circle, Galaxy Digital, CBOE and others disclosing their banking relationships with Silvergate. Coinbase has explicitly announced its move to Signature banking.

“We are facilitating withdrawals and fiat deposits using Signature Bank, effective immediately.” — Coinbase Memo

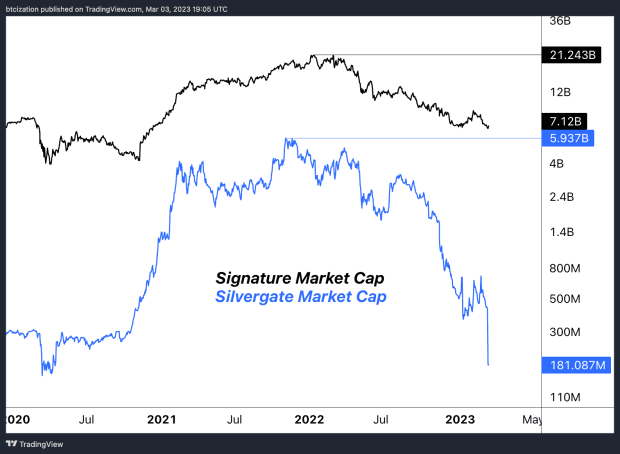

One of the concerns is that many of these companies only look to Signature Bank, which further centralizes the exit and on-ramps currently used by the crypto industry, even though Signature has a much larger market capitalization. size and a more diverse depositor base than Silvergate.

The current status of Signature’s digital asset deposit base is unknown, as the company signaled its desire to reduce its reliance on crypto-related deposits in early December.

“Signature Bank (SBNY) will reduce its cryptocurrency-related deposits by $8 billion to $10 billion, signaling a move away from the digital asset industry for the bank, which until recently was one of the fastest growing companies. crypto-friendly on Wall Street.

“We’re not just a crypto bank and we want to make that crystal clear,” Signature Bank CEO Joe DePaolo said at an investor conference in New York hosted by Goldman Sachs Group on Tuesday. — Coindesk

The timeline of these events is important due to recent developments regarding the industry leak from Silvergate, just as Signature appears to be handcuffing the use of its rails with major industry players.

Final remark

After a disastrous 2022, regulators are stepping up their scrutiny of the crypto industry, and one of their main focus is the link between the industry and the legacy banking system. While Silvergate appears to be almost dead in the water with nearly every major industry player announcing their intention to sever ties, the growing reliance on Signature Bank, a bank which has announced its intention to distance itself of space, remains… disturbing.

While this poses no fundamental risk to the operation of the Bitcoin network or its properties as an immutable settlement layer, the repression and increasing centralization of USD on- and off-ramps poses a key risk to short-term liquidity. and in the medium term in bitcoin. and a broader crypto market.

Do you like this content ? Subscribe now to receive PRO articles straight to your inbox.

Relevant previous articles:

- The bigger they are…

- The Exchange War: Binance Smells Blood as FTX/Alameda Rumors Rise

- Crypto in the Line of Sight and Bitcoin Futures

- Genesis Files for Chapter 11 Bankruptcy and Owes Creditors Over $3.5 Billion

- Counterparty risk occurs quickly

- Collapse in Crypto Yield Offerings Signals ‘Extreme Constraint’

- Crypto-contagion intensifies: who else is swimming naked?

- The contagion continues: top crypto lender Genesis is next on the chopping block