Subscribers to Cointelegraph’s Markets Pro data analytics platform each week receive a detailed breakdown of the week’s best performance and the performance of the VORTECS™ Score index in tracking potential bullish and bearish developments.

Here are some of the highlights from the latest report:

- Axie Infinity Shard (AXS) set a new all-time high after a solid VORTECS™ result.

- Three out of ten top price drivers flash a VORTECS™ score of 80 or higher before peaking.

- NewsQuakes™ alerts gave traders an early indication of the high of the NEAR and the double-digit RAY.

- VORTECS™ Scorers’ best all-time average gains against Bitcoin (BTC) showed the biggest returns coming in 24 and 72 hours after the asset’s flash results at 80 and 90.

- Community members shared information about tokens and successful trading strategies.

AXS charts its own path to the moon

Axie Infinity’s excellent AXS run to a new all-time high of $155.27 has also shocked many investors, and it deserves special attention.

The asset’s rise in value follows its growing usefulness in the virtual Axie Infinity world where players generate, trade and fight Non-Foldable Token (NFT)-based beings called Axies to earn AXS along with another token called Smooth Love Potion (SLP). There are now over 1.85 million active players in the game, which is a 4,500% increase since April 2021.

It is clear that the asset has seen some explosive rallies en route to the current valuation. The data generated throughout this time has allowed the VORTECS™ Index, exclusive to Cointelegraph, to be highly proficient in recognizing the telltale signs of an AXS breach.

The Cointelegraph Markets Pro-exclusive VORTECS™ score is an algorithmic comparison of historical and current social and market conditions around a coin calculated from a range of variables including market sentiment, trading volume, recent price movements and Twitter activity.

While the indicator will not tell investors when to buy or sell, it can provide insights based on bullish or bearish conditions for a particular currency. According to the algorithm, the higher the result, the more likely it is that the observed conditions will be historically favorable for the next 12 to 72 hours.

In the case of AXS, historical precedents seem particularly useful.

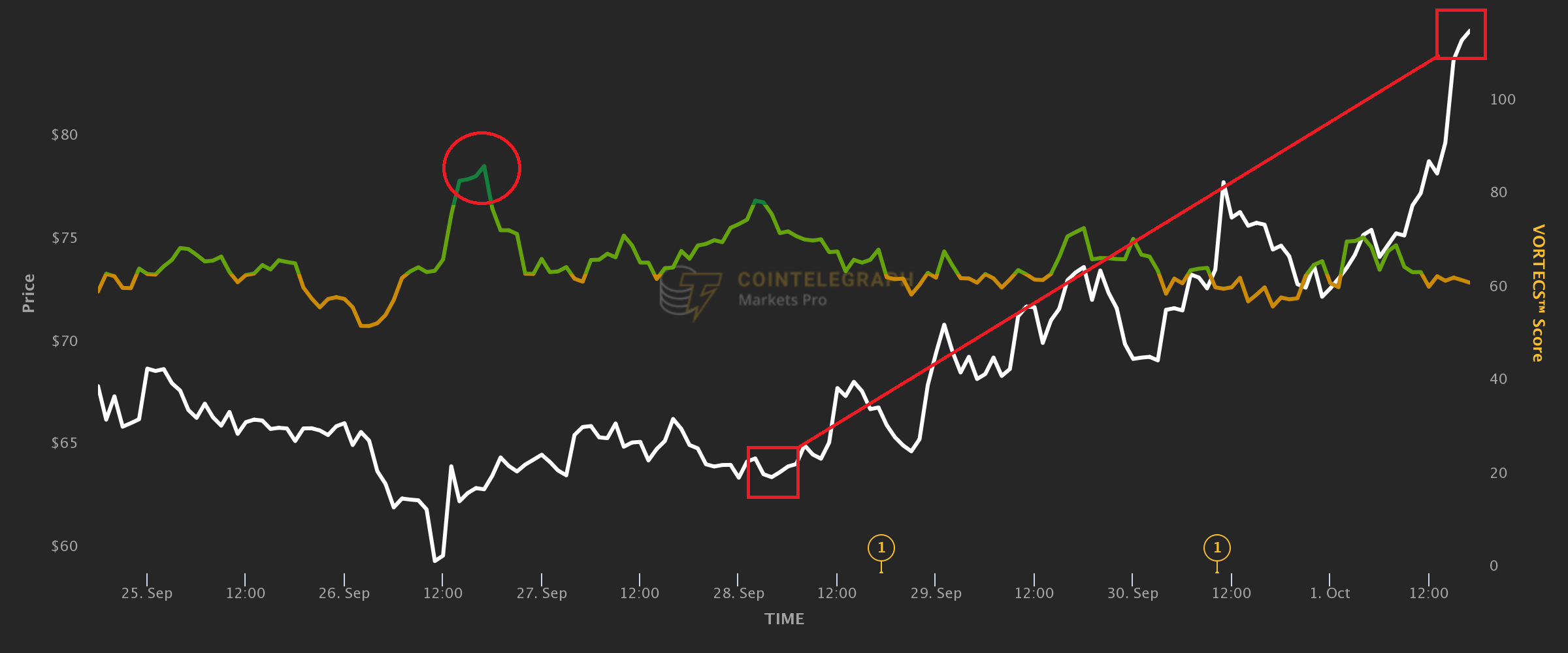

Between September 25 and October 2, AXS gained 76.67% against the US dollar and 56.05% against bitcoin, reaching a new all-time high above $117.

AXS peaked with a VORTECS™ result of 87 on Sept 26 when its price was $63.15, and the model recognized a historically bullish setting for market dynamics and social sentiment. The hack started two and a half days later when the coin started steadily rising from $65 to $117 on October 2.

All-time top scorer

With a total of 60 days during which a VORTECS™ score reached 80 or higher, AXS remains the second best performer ever in terms of high-score days, trailing only THORChain RUNE.

However, the average returns of AXS after high scores are much better than that of RUNE.

On average, AXS gained 4% 24 hours after the VORTECS™ score reached 80, 7% after 48 hours and 10% after 72 hours. Looking at the occasions when a coin has reached the 90 VORTECS™ mark, the average coin returns are even more impressive: 7% after 24 hours, 13% after 48 hours, and 21% after 72 hours.

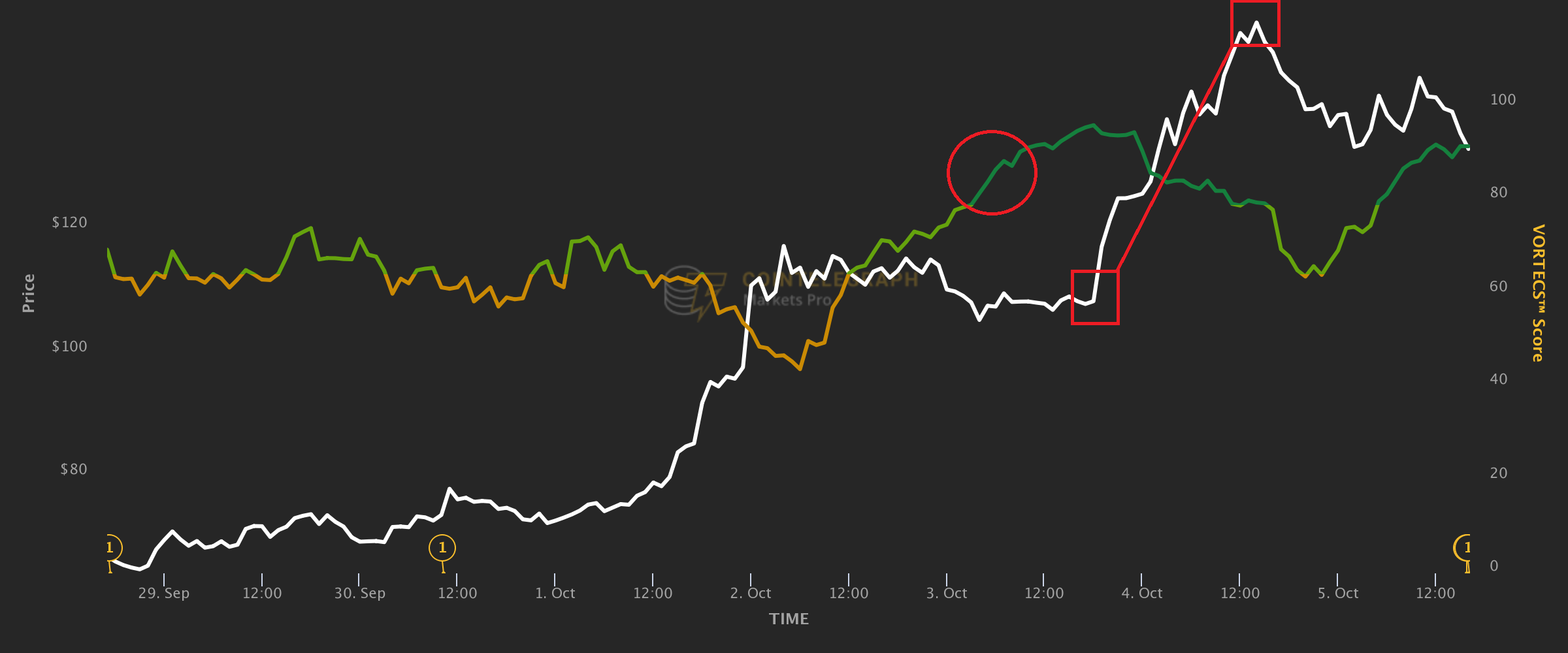

The coin’s price stabilized on October 2 and 3 after hitting an all-time high above $117. With the price continuing to stabilize, the result of AXS’ VORTECS™ started to rise sharply again, crossing the threshold of 80 when it was trading at $105 and climbing to 96. Fifteen hours after hitting 80, the price of AXS reached a record high of $153.70 .

Currently, AXS’s VORTECS™ score is back in the 80s, so it’s very likely the feast isn’t over yet.

Cointelegraph is a financial information publisher, not an investment advisor. We do not provide personal or individual investment advice. Cryptocurrencies are volatile investments and involve significant risks including the risk of permanent and complete loss. Past performance is not indicative of future results. Figures and graphs are correct at the time of writing or as otherwise specified. The directly tested strategies are not recommendations. Consult your financial advisor before making financial decisions.