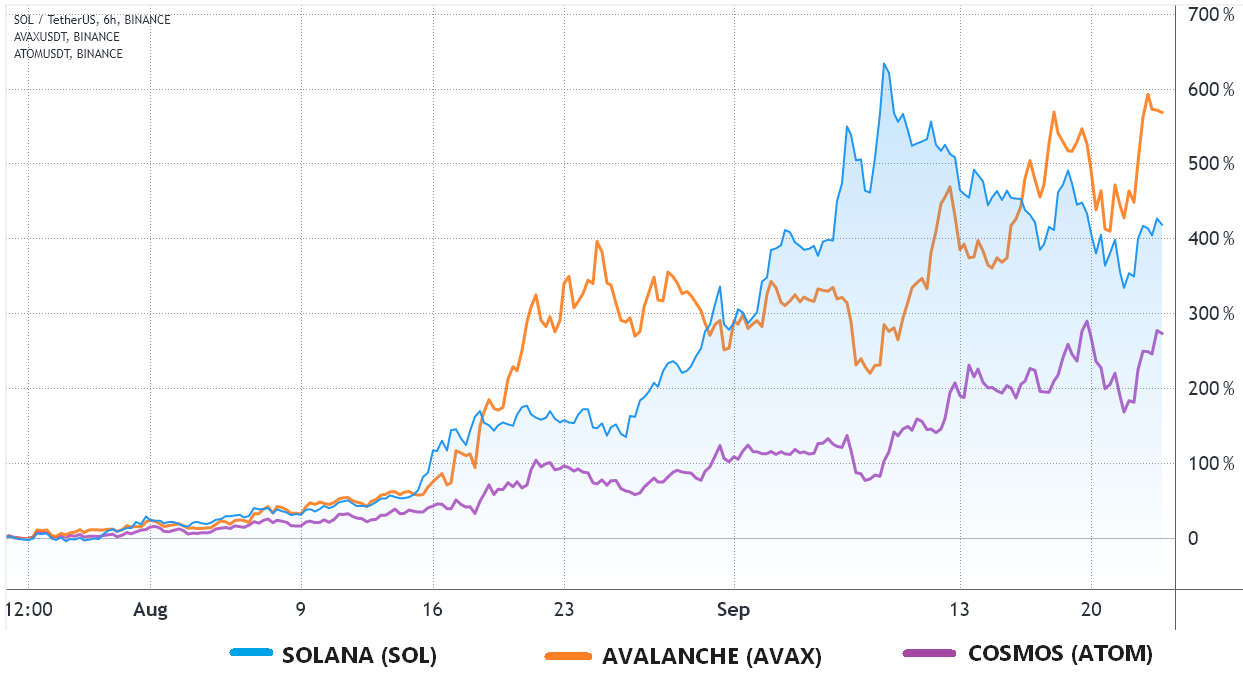

Solana (SOL) reached its highest level at $216 on September 9 after rising 508% since August. The upside has caused some analysts to expect a target of $500 which would translate into a market capitalization of $150 billion.

It is worth noting that during the SOL rally, the average transaction fee for the Ethereum network exceeded $40. Increased interest in the NFT market has accelerated investors’ move to Solana, which was boosted by the September 6 launch of FTX’s NFT Marketplace.

The chart above shows SOL’s two-month performance compared to Avalanche (AVAX) and Cosmos (ATOM). Both are fighting for the same decentralized application user base and offer faster and cheaper transactions compared to Ethereum (ETH).

Major industry players have also invested in Solana’s ecosystem due to its ability to take on Ethereum. In June, Andreessen Horowitz and Polychain Capital led a $314 million funding round in Solana Labs, which was also funded by venture capital firm Andreessen Horowitz, Polychain Capital and Alameda Research.

Does Solana outage affect the price of SOL?

At the SALT 2021 conference, Solana founder and CEO, Anatoly Yakovenko, told Cointelegraph that the network is “optimized for a specific use case: a centralized online limit order book, a trading method used by exchanges that matches bids with offers. It is designed for market makers who need sending millions of transactions daily.”

Yakovenko then added, “There are Pareto efficiency trade-offs. If I improve hash power security, then I can’t get much TPS. You have to choose one or the other.”

Strangely enough, on September 14, Solana’s network experienced an outage that lasted for more than 12 hours. The team explained that a significant increase in transaction load to 400,000 per second overwhelmed the network, resulting in a denial of service that caused validators to start skipping.

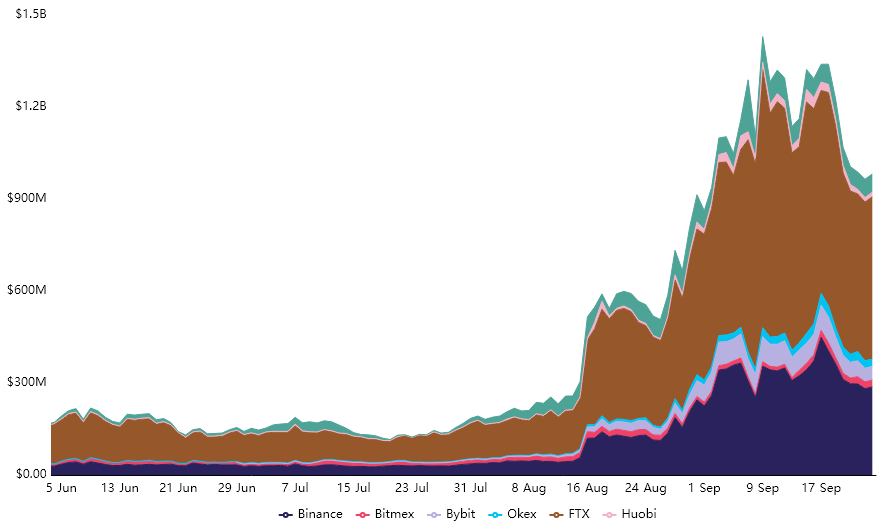

Despite the recent setback, the total open interest for Solana futures markets is $1 billion, an increase of 640% in two months. This number makes Solana’s derivatives market the third largest, after Bitcoin (BTC) and Ether. This data confirms investor interest, but cannot be considered bullish because futures buyers (buys) and sellers (sells) are identical at all times.

Derivatives markets indicate a balanced situation

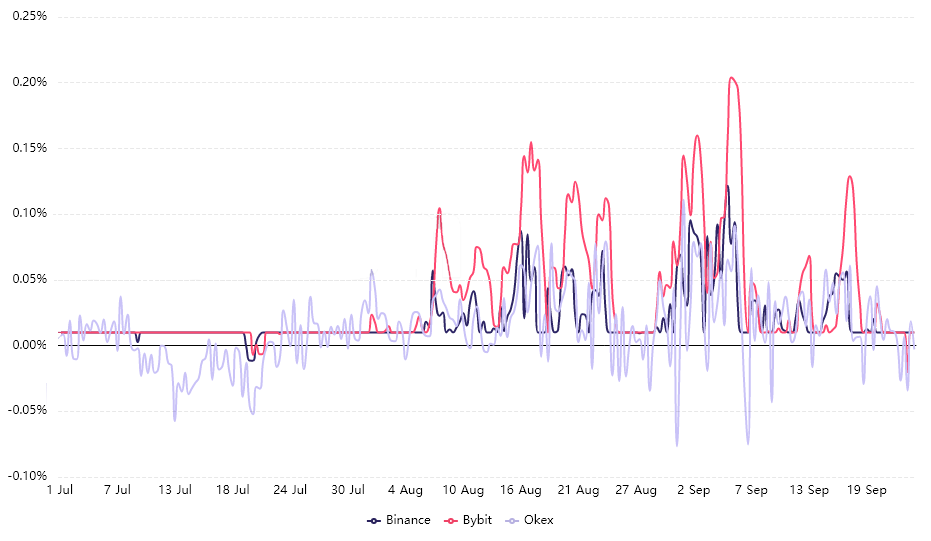

To answer this question, one must analyze the financing rate. Perpetual contracts, also known as reverse swaps, have a built-in rate that is typically charged every eight hours. This fee ensures that there are no misalignments in exchange risk. A positive funding rate indicates that it is the longer contracts (buyers) that require more leverage.

However, the opposite situation occurs when short positions (sellers) require additional leverage, and this causes the financing rate to turn negative.

As shown above, the eight-hour fee peaked at 0.12% on September 5, which is 2.5% for the week. This intraday rally quickly stabilized as SOL faced heavy volatility on September 7. After peaking at $195, the SOL price collapsed by 35% within 9 hours and liquidated leveraged positions, resulting in the current equilibrium between long and short positions.

The data shows no evidence of investors rushing to add long leveraged positions despite the current open interest of $1 billion. Moreover, given the 410% gains in the past two months, traders have reason to fear a further decline because Bitcoin has also failed to break the psychological barrier of $50,000 and has yet to confirm whether the recent drop below 40 is, $000 is the bottom in the short term.

The opinions and opinions expressed here are solely those of author and do not necessarily reflect the opinions of Cointelegraph. Every investment and trading move involves risks. You should do your research when making a decision.