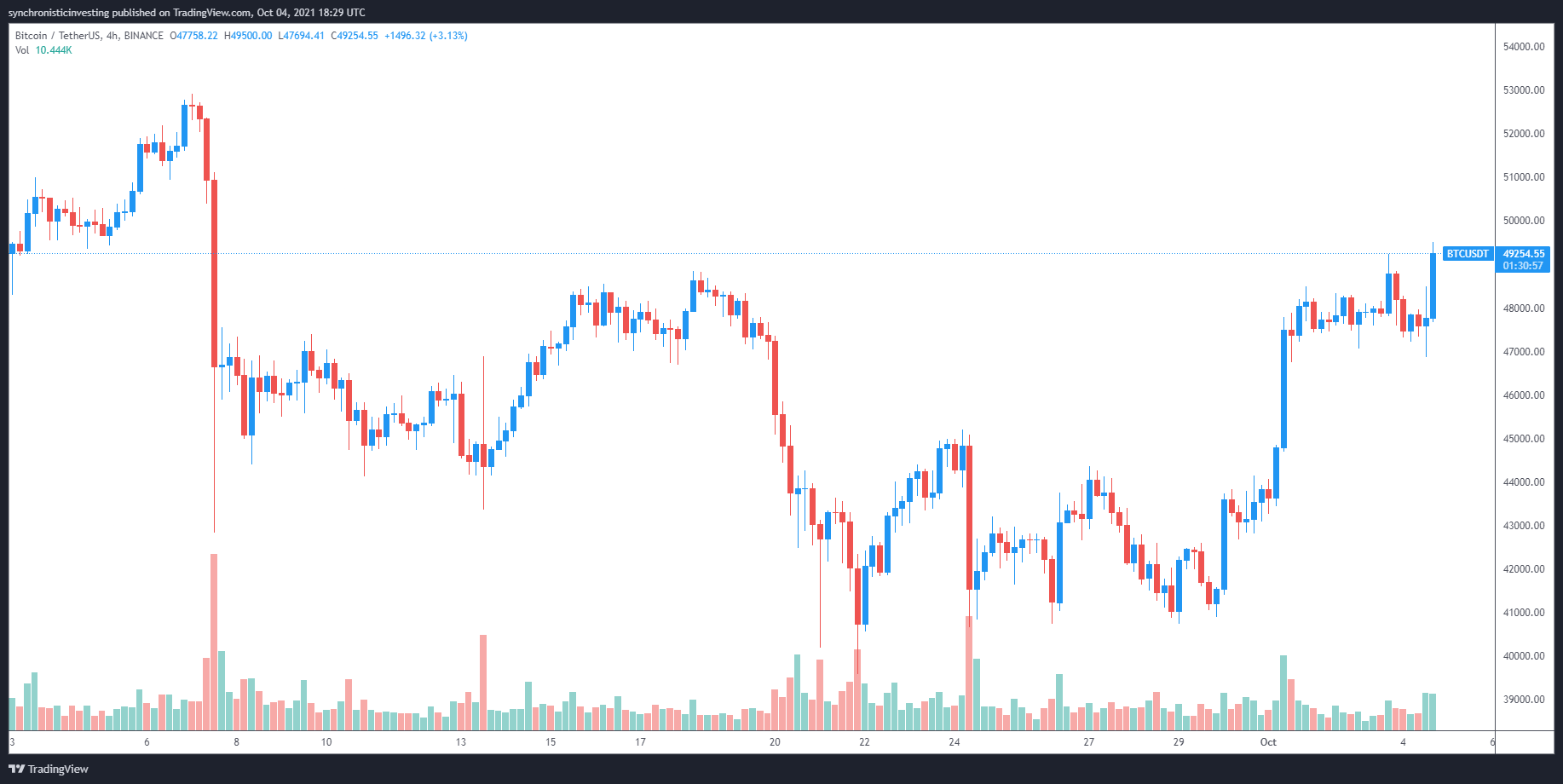

The bulls flexed their muscles on October 4, and evidence of this came as the price of Bitcoin (BTC) rose in the $500 range from the $50,000 mark. This move towards major psychological resistance helped pull the Crypto Fear & Greed indicator from its fear zone to “neutral” on Monday.

The price action of the best cryptocurrencies has seen increased volatility in recent weeks as countries like China have increased their crackdown on cryptocurrencies, a move that former CIA agent Edward Snowden says has “made bitcoin stronger”.

Data from Cointelegraph Markets Pro and TradingView shows that after an early morning bear attack that pushed BTC to a low of 46,863, bulls reached with consolidation and pushed the price back above the $49,200 support/resistance (S/R) area where they are fighting Now to control.

Here’s a look at traders and analysts considering the current price action and what could happen next as BTC price approaches $50,000.

$48,700 is a key resistance level

Traders have shown keen interest in buying the latest BTC price drop according to crypto analyst and Twitter user pseudonym ‘Rekt Capital’, who Spread The following chart shows that “Bitcoin’s recent dip has been aggressively bought up.”

The analyst was quick to point out that the price is still “battling with this red resistance area at $48,700” and needs to see him turn in support if the bulls are hoping to push the price higher.

Rekt Capital said:

“This is the area that needs flipping to support a re-visit of more than $50,000.”

BTC needs a daily close above $50,000

The importance of a close above $50,000 was also emphasized by options trader and Twitter user pseudonym ‘John Wick’, who posted the following tweet emphasizing that the bitcoin price needs to close and hold above the psychologically important level in the short term.

We have clear support and resistance areas. I feel like we need to see close and also hold over $50K if we want to see ATH.

October is usually a great month for # bitcoin to climb higher. We have the right environment and technologies to reach ATH this month imo. pic.twitter.com/DZDfLAIK3I

– John Wick (@ZeroHedge_) October 4, 2021

The analyst noted that October has historically been a “great month for bitcoin to climb higher” and noted that the current environment and technical signals indicate that BTC has the potential to create a new all-time high in the next four weeks if the $50,000 hurdle can be cleared.

Related: Bitcoin surpasses $49K as Facebook, Instagram and WhatsApp drop

The current range is high $55,000

A final bit of bullish insight was provided by bitcoin trader and Twitter user pseudonym “George,” who posted the following chart highlighting the current trading range in order to identify the best areas to look for to open long positions.

George said:

“Look for long positions as close to the lower range as possible. Target range is high and daily supply ~55K ISH.”

The total cryptocurrency market capitalization is now $2.158 trillion and the Bitcoin dominance rate is 42.9%.

The opinions and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should do your own research when making a decision.