BitMEX co-founder Arthur Hayes has predicted that the Federal Reserve may soon begin printing money again if the dollar continues to strengthen against international currencies. As he sees it, this is a bullish development for Bitcoin.

The Effects of a Strong Dollar

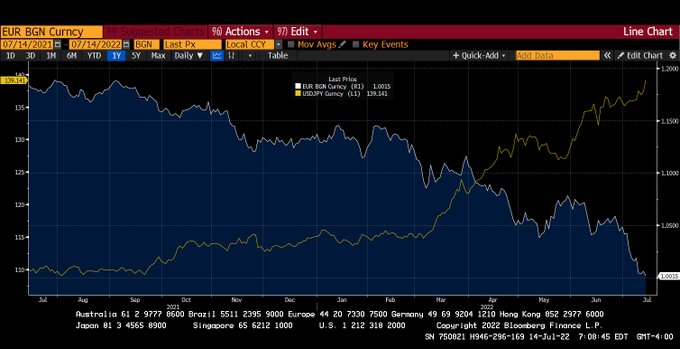

In a tweet on Thursday, Hayes pressed followers to keep their eyes on both the Japanese Yen and the Euro. He said he expects an intervention to weaken the US dollar if it strengthens above 150 JPY, or if the Euro falls below $0.9 USD.

“Intervention means the Fed printing money,” he explained. “Printing money means $BTC number go up. The situation is fluid.”

The former CEO linked an image displaying the latest movements of the Euro and Yen against the dollar. One dollar is now worth about 139 JPY, whereas the Euro has fallen to dollar parity. Both show a clear trend of weakening in USD terms over the past year.

For the United States, a strengthening dollar means consumers and businesses can more easily purchase international products. It also strengthens the dollar’s position as the world reserve currency – something the White House expressed strong interest in maintaining in its crypto executive order in March.

However, it also means that US exporters suffer as international buyers have more trouble affording their goods – as do tourists within the US.

Furthermore, foreign entities servicing dollar-denominated debt may face an added strain, forcing them to sell US treasuries and equities. This could force bond prices down, raising their effective yield.

Bond yields are already moving higher as the Fed continues tightening interest rates to combat inflation. In fact, 2-year Treasury bond yields have already surpassed those of their 10-year counterparts – an inversion often viewed by markets as a harbinger of recession.

Impact on Bitcoin

Crypto performed strongly in 2021 relative to other assets, as the Federal Reserve pursued a dovish monetary policy to keep the economy afloat. However, as the Fed began showing a stronger commitment to its rising interest rate policy in May and June, Bitcoin’s price soon collapsed back to late 2020 levels.

The crypto market has tightly tracked the equities market over the past year – but with increased upside and downside volatility. Even long-term investors who view Bitcoin as a safe haven admit that it is currently treated by markets like a “growth stock.”

As such, many investors believe that Bitcoin’s performance is largely dictated by Federal Reserve policy. Galaxy Digital CEO Mike Novogratz predicted last month that Bitcoin will quickly rebound once the central bank reverses course.

“The moment the Fed flinches, I think you’ll see lots of traditional macro funds, who’ve had a great year, buy Bitcoin,” he said.

FTX CEO Sam Bankman-Fried also believes that rising interest rates are primarily responsible for the crypto market downturn. “At this point, the current we’ve seen in markets I think is out of line with what three percent interest rates would normally represent,” he told Real Vision last week.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to receive up to $7,000 on your deposits.