Solana Price Techniques (SOL) suggest that SOL could be as high as $275 in upcoming sessions.

The bullish outlook for the world’s sixth largest cryptocurrency by market capitalization comes as it consolidates within a range that looks like Bull Pennant.

In detail, Bull Pennants are bullish continuation indicators that form as the price consolidates within a symmetrical triangle-like structure after a strong upward move.

A coherent trend is accompanied by decreasing volumes, which reflects the underlying weakness of the trend.

As the price approaches the top – the point where the pennant trend lines converge, it tends to break through to the upside, with a bullish target with a length equal to the height of the previous uptrend, i.e. flagpole.

Solana’s flagpole is about $125 high. However, the breakout move at the top of Pennant (at around $150) put SOL on its way to $275.

SOL/BTC is also gaining despite Bitcoin price at $60K

Solana’s odds of hitting $275 come amid an all-out price boom in the cryptocurrency market.

However, SOL’s price has also risen 8% against Bitcoin (BTC) in the past two days in part due to its listing of South Korea’s largest crypto exchange Upbit.

RELATED: ‘Bull Flag’ on Solana chart eyes $250 despite SOL down 40% since last week

Overall, SOL was one of the best performing cryptocurrencies in 2021, with a YTD return of 8,500%. SOL traded at a record high of $216 in early September.

Institutional inflows boost the price of SOL

Although Bitcoin is currently in the spotlight, it is possible that Solana’s price has also received a boost from institutional capital via dedicated investment funds, according to a report by CoinShares published earlier this week.

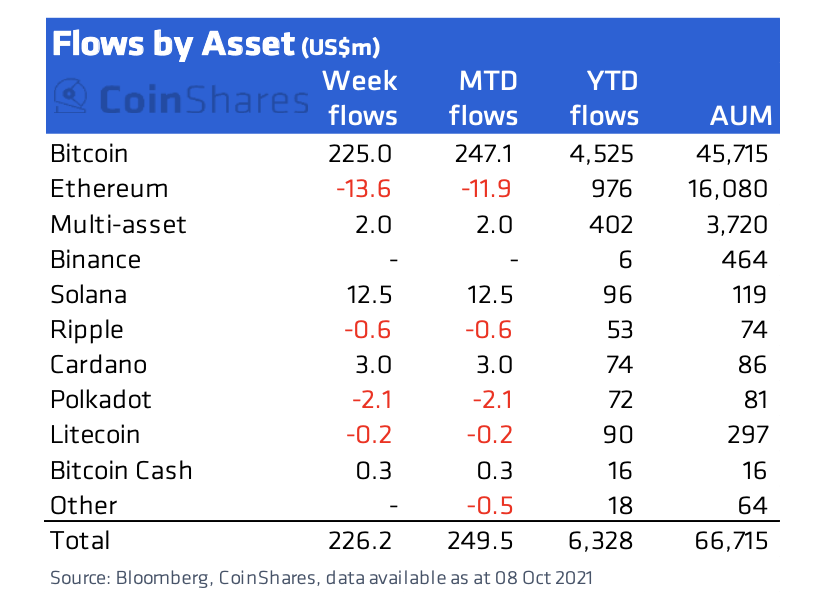

CoinShares noted that “the digital asset investment products saw 500 inflows totaling $226 million, bringing inflows over 8 weeks to $638 million,” adding:

“It has been a mixed picture in other cryptocurrencies with favorites Solana ($12.5M) and Cardano ($3M) continuing to see flows, indicating that the focus has not shifted entirely to Bitcoin.

The opinions and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should do your own research when making a decision.